The CMC Markets spread betting account, for UK and Ireland residents, provides tax-free gains on over 9,500 instruments. You’ll get the same great platforms and services as CFD traders.

Professional clients can open a CMC Markets Prime account with direct market access, lower spreads, and high volume discounts. You’ll need to meet eligibility criteria but get premium service and VIP client management.

No matter your account type, CMC Markets has you covered with award-winning platforms, apps, and support. You’ll find a solution for your trading level and the freedom to switch between accounts as your needs change.

Trading Platforms Provided by CMC Markets

CMC Markets offers two robust trading platforms to suit your needs. Here are the two trading platforms of CMC Markets:

CMC Trader

This web-based platform is ideal for casual traders. It’s user-friendly, with an intuitive interface and built-in charts and analysis tools. You can monitor the markets, place trades, and manage your account wherever you have internet access.

CMC Markets Next Generation

For active traders, Next Gen delivers a customizable desktop experience. Advanced features include level II pricing, algo orders, and API access.

Choose from multiple chart types with dozens of indicators and drawing tools. Automate your trades or build your algorithms. Next Gen provides professional-grade functionality in an easy-to-navigate platform.

With a choice of basic or advanced platforms, CMC Markets has you covered whether you’re a novice getting started or a seasoned pro. Their award-winning technology and competitive pricing make CMC Markets a top broker for traders of all experience levels.

Commissions, Spreads, and Fees of CMC Markets

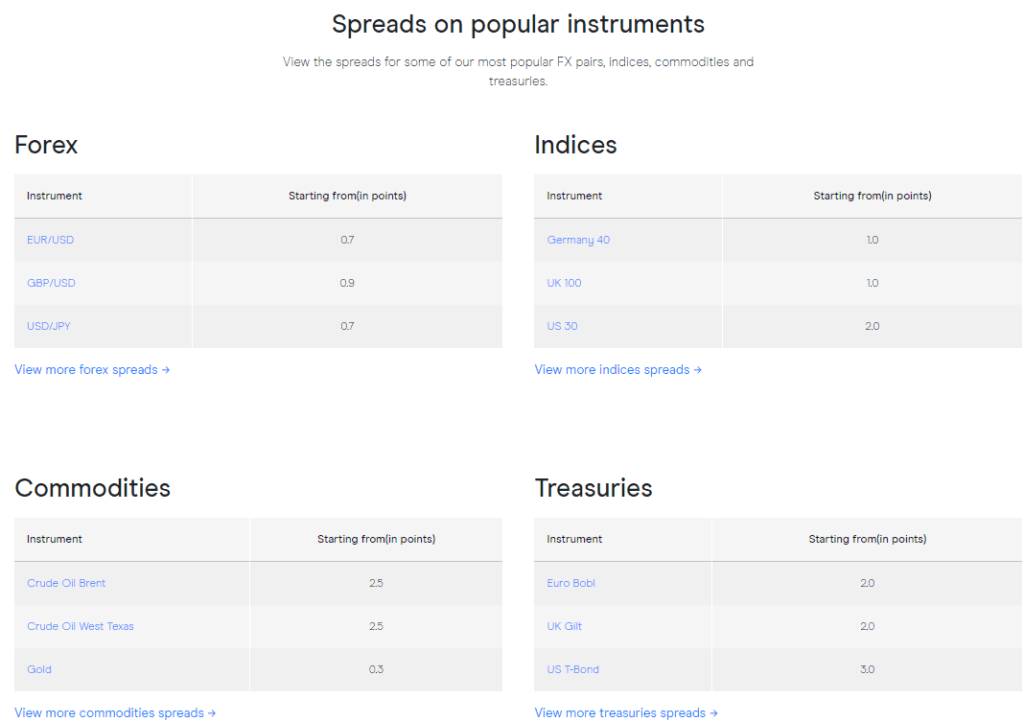

CMC Markets charges fairly average commissions and spreads compared to other brokers. For share trading, you’ll pay a minimum commission of $11 per trade. Its CFD trading fees are also pretty standard. The spread for major currency pairs like EUR/USD starts from just 0.7 pips. For commodities, the spread for crude oil CFDs is around $0.03 per barrel. Index CFD spreads are very competitive too, with spreads for Wall Street 30 from just 1 point.

Commissions, Spreads, and Fees of CMC Markets

CMC Markets charges fairly average commissions and spreads compared to other brokers. For share trading, you’ll pay a minimum commission of $11 per trade. Its CFD trading fees are also pretty standard. The spread for major currency pairs like EUR/USD starts from just 0.7 pips. For commodities, the spread for crude oil CFDs is around $0.03 per barrel. Index CFD spreads are very competitive too, with spreads for Wall Street 30 from just 1 point.

How to Open a Live Trading Account at CMC Market- Step-by-Step Guideline

Opening a live trading account with CMC Market is quick and easy. You just need to follow some simple steps. Here are those steps:

1. Register

First, visit the CMCMarket website and click ‘Register’ on the top right corner of the page. Provide some basic personal info like your name, email address, and password.

2. Verify your ID

For security, you’ll need to verify your identity by uploading a government ID, like your passport or driver’s license, as well as proof of address like a utility bill. This helps prevent fraud and ensures you’re eligible to trade.

3. Deposit funds

You can deposit funds through wire transfer, eCheck, debit, or credit card. CMC Market does not charge deposit fees. Your initial deposit amount will depend on the type of account you want to open.

4. Choose an account

CMCMarket offers Standard, Active Trader, and Spread Betting accounts based on your trading experience and needs. Discuss the options with your account rep.

5. Start trading

Once your account is funded and verification is complete, you’re all set to start trading CFDs, spread bets, forex, shares, indices, cryptocurrencies, commodities, and more on CMC Market’ award-winning trading platforms. Happy trading!

What are the Alternatives of CMC Market?

Do you think CMCMarket can’t meet your needs? If yes, then don’t need to worry! There are some other alternatives for you. Here are a few good options:

eToro

eToro is a multi-asset brokerage firm based in the UK. It offers commission-free stock and ETF trading, as well as crypto, indices, and commodities. eToro has a simple, easy-to-use platform and app. It’s a great choice if you’re a beginner.

XM

XM is an award-winning broker regulated in Australia, with over 5 million clients worldwide. It offers tight spreads, fast execution, and a range of account types. You can trade forex, stocks, commodities, indices, and crypto. XM provides free forex education and market analysis.

AvaTrade

AvaTrade is an Irish broker regulated in the EU, Australia, Japan, and BVI. It offers a choice of user-friendly platforms, as well as automated and social trading. You have access to forex, stocks, bonds, ETFs, CFDs, indices, and cryptocurrencies. AvaTrade is a reputable, well-regulated broker, suitable for traders of all experience levels.

Is CMC Market Legal or Scam?

CMC Market is a reputable broker, so you can rest assured it’s not a scam. CMC is regulated by top-tier authorities like the FCA in the UK, ASIC in Australia, MAS in Singapore, and FSCA in South Africa. These regulators impose strict rules around areas like client funds segregation, trade transparency, and ethical practices.

It has also been in business since 1989, so they have decades of experience and stability on their side. With CMC, your funds and personal information will be in good hands. You can feel confident trading with this trusted broker.

If you have lost money to companies like XM Broker, FP Markets, or IG Markets, please report it today by the below form.

Final Thought

With competitive pricing, a choice of advanced platforms, and over 9,000 tradeable instruments, CMCMarket gives you everything you need to take your trading to the next level. Whether you’re just getting started or a pro, CMC Market has an account to suit your needs. Thank you all for reading this article.