CurrencyFair is an online currency exchange platform that facilitates international money transfers with competitive exchange rates. Founded in 2010, the platform allows users to send money globally at lower costs compared to traditional banks. CurrencyFair operates on a unique model, matching individuals looking to exchange currencies in different countries.

This platform provides transparency in the exchange process. It allows users to set their exchange rates or choose from existing ones in the marketplace. With a user-friendly interface and secure transactions, CurrencyFair has gained popularity for its cost-effective and efficient international money transfer services. Keep reading to learn more about this platform.

A Detail Table on CurrencyFair

Features | Descriptions |

Found Year | 2009 |

Services | International money transfers with competitive rates |

Cost-Effective | Lower transfer costs compared to traditional banks |

Market Presence | Established and trusted in the financial technology sector |

Popular for | Efficient and cost-effective global money transfers |

Security | Secure transactions and user data protection |

How Does CurrencyFair Work?

Currency Fair is a peer-to-peer currency exchange platform. Rather than trading money through banks, CurrencyFair connects people directly to swap currencies.

You sign up for a free account and verify your identity. Now go for CurrencyFair login and enter the details of the transfer like the amount, currencies involved, and recipient info. Currency Fair finds other users to match your trade and executes the exchange.

The money is transferred directly between users, so no middleman is taking a cut. Currency Fair only charges a small fee for facilitating the transaction. They aim to offer the mid-market exchange rate, so you get a fair deal and often beat the rates offered by most banks.

Transfers typically take 1-2 business days. Once the money is received, CurrencyFair notifies you and the recipient. It’s a convenient, low-cost way to send money internationally, perfect for expats, students studying abroad, or businesses operating globally.

What are the Key Features of CurrencyFair

it is a popular money transfer service. It offers various features to the customers. Here are some of the key features that make CurrencyFair stand out:

Low Transfer Fee

You’ll get some of the lowest transfer fees around. Currency Fair charges just 0.5% on transfers over €1,000, and fees go as low as €3 for smaller amounts. Compare that to the 3-5% many banks charge for international transfers!

Competitive Exchange Rate

The exchange rates are very competitive. Currency Fair’s peer-to-peer platform allows people to trade currencies directly with each other. This means you’ll often get a rate that beats the banks.

Fast and Secure

Transfers are fast. Most transfers are completed within 24 hours. Funds are debited instantly from your account, so there’s no waiting for checks to clear. It uses the latest security protocols to keep your funds and personal information safe.

User-Friendly Platform

It’s simple to use. Currency Fair’s website and app make the transfer process straightforward. You can set up transfers in just a few clicks and their customer service team is always ready to help if you get stuck.

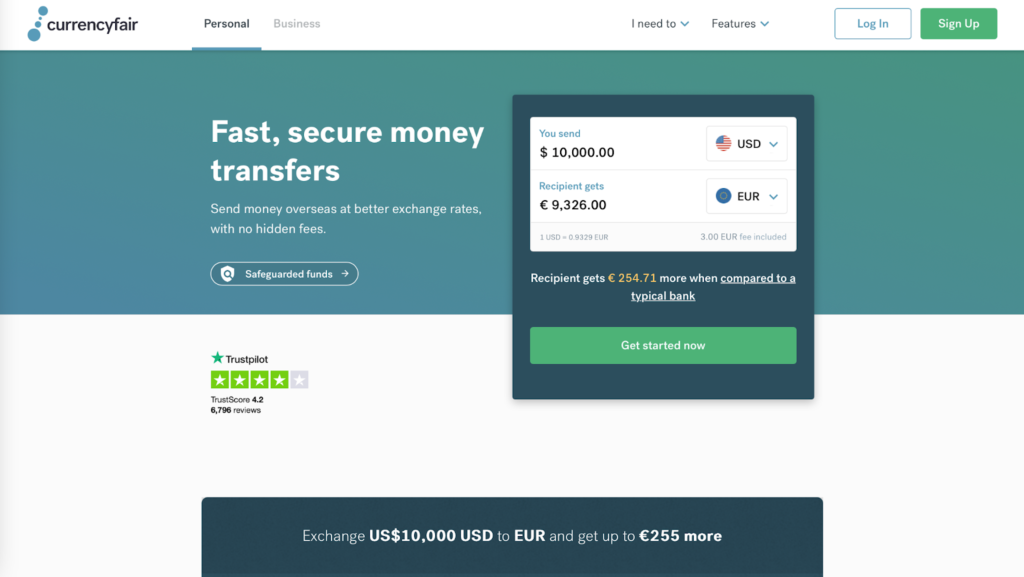

CurrencyFair Exchange Rates and Fees

When using Currencyfair for money transfers, you’ll pay a small fee for each transaction. Unlike big banks that can charge high flat fees and take a percentage of your transfer amount, CurrencyFair keeps costs low.

Currency Fair charges a fixed fee for transfers rather than a percentage of the amount. For most major currencies, you’ll pay just €3 per transfer. For some smaller currencies, the fee may be slightly higher at €7. Either way, you’ll know the exact fee before you initiate your transfer.

There are no hidden Currencyfair fees or markups on the exchange rate. The rate you see is the same rate CurrencyFair receives, so they make money through the flat fees rather than by marking up the exchange rate. This transparency allows you to see exactly how much you’re paying and how much the recipient will get.

Compared to traditional banks, these small fees can save you a bundle, especially on larger transfers. And if you transfer money regularly, CurrencyFair offers a premium membership with unlimited free transfers and other benefits for just €10 per month.

For most people sending money abroad, Currency Fair provides an affordable and convenient option. Their simple fee structure and great exchange rates allow you to keep more money in your pocket and get the most for your dollar, pound, or euro.

What are the Alternatives of CurrencyFair

If Currency Fair’s fees or limited transfer options don’t work for you, there are a few good alternatives. Here are some of the alternatives you can choose if Currencyfair doesn’t meet your needs.

Wise

Wise is one of the biggest names in international money transfers. They offer transfers to over 70 countries with low, upfront fees. You can send money via bank transfer or mobile payment networks for most transfers. If you compare Currencyfair and Wise, Wise’s convenience and availability can make them worth considering.

Xe Money Transfer

Xe is a trusted currency exchange and remittance provider. They specialize in transfers to over 170 countries and territories. Fees are also low and disclosed upfront. Xe offers bank transfers, as well as cash pickups and mobile payment options for many destinations. Their customer service and mobile apps get high marks, so Xe is a solid Currencyfair alternative.

SBI California

SBI California is a popular choice for sending money from the U.S. to India. They focus specifically on the U.S.-to-India remittance corridor and offer highly competitive exchange rates and low fees. Transfers can be made via direct deposit to Indian bank accounts, as well as cash pickups throughout India. If India is your primary destination, SBI California may save you time and money versus using a more general remittance service.

Who Should Use CurrencyFair Money Transfer?

CurrencyFair is ideal for certain types of users who can benefit the most from its low-cost money transfer services and unique peer-to-peer currency exchange platform.

Freelancers and Remote Workers

If you work as a freelancer for international clients or are employed remotely for a company in another country, CurrencyFair can save you a lot on fees to transfer your earnings or pay for services. Their low, transparent fees and competitive exchange rates mean more of your hard-earned money stays in your pocket.

Small Business Owners

For small business owners, every cent counts. Currency Fair’s affordable international money transfers and currency exchanges are an easy way to cut costs. Pay suppliers overseas, transfer funds between company accounts in different countries, or make other cross-border payments your business requires.

Expats and International Students

If you live, work, or study outside your home country, Currency Fair provides a simple, low-cost way to transfer money internationally as needed. Send money to your family back home or transfer it between your accounts in different currencies and countries. Its simple interface and helpful customer service make the process easy even when navigating different financial systems.

Retirees Abroad

For those enjoying retirement in another country, CurrencyFair offers an affordable option to transfer your pension payments or other funds from your home country so you can access them wherever you are. Their competitive exchange rates and low fees mean less of your money is lost to the banks and more stays in your pocket during your well-deserved retirement.

If you have lost money to companies like Forex Sport, Quadcode, or JB Markets, please report it today by the below form.

Final Thought

CurrencyFair offers a simple and affordable way to send money abroad. Between the competitive exchange rates, low transfer fees, and convenient mobile app, Currency Fair has a lot going for it. If you frequently need to move money between countries or have friends and family living abroad, CurrencyFair is worth checking out. Thank you all for reading this CurrencyFair review.