Navigating the complex world of online trading requires choosing a reliable and trustworthy broker. With countless options available, selecting the right platform can be a daunting task. In this comprehensive easyMarkets review, we’ll delve into their features and details, to help you decide if it’s the ideal fit for your trading journey.

Summary Table

| Feature | Description |

| Regulation | BVFSC, CySEC, ASIC, FSA |

| Minimum Deposit | $25 |

| Leverage | Up to 1:2000 |

| Spreads | Variable (widening on some pairs) |

| Platforms | MetaTrader 4 & 5, WebTrader |

| Asset Coverage | Forex, CFDs on Indices, Commodities, Crypto, Vanilla Options |

| Account Types | Standard, Premium, VIP |

| Education | Video tutorials, webinars, ebooks |

| Customer Support | 24/5 Live chat, email, phone |

easyMarkets Company Overview

Established in 2001 and regulated by ASIC (Australia) and CySEC (Cyprus), it boasts a strong track record and commitment to transparency. Their core mission lies in making trading accessible and user-friendly for everyone, regardless of experience level. They achieve this through innovative features like guaranteed stop-loss orders and negative balance protection, aiming to mitigate potential risks for their clients. easyMarkets is a trading name of EF Worldwide Ltd registration number: 2031075. This website is operated by EF Worldwide Limited (part of Blue Capital Markets Group).

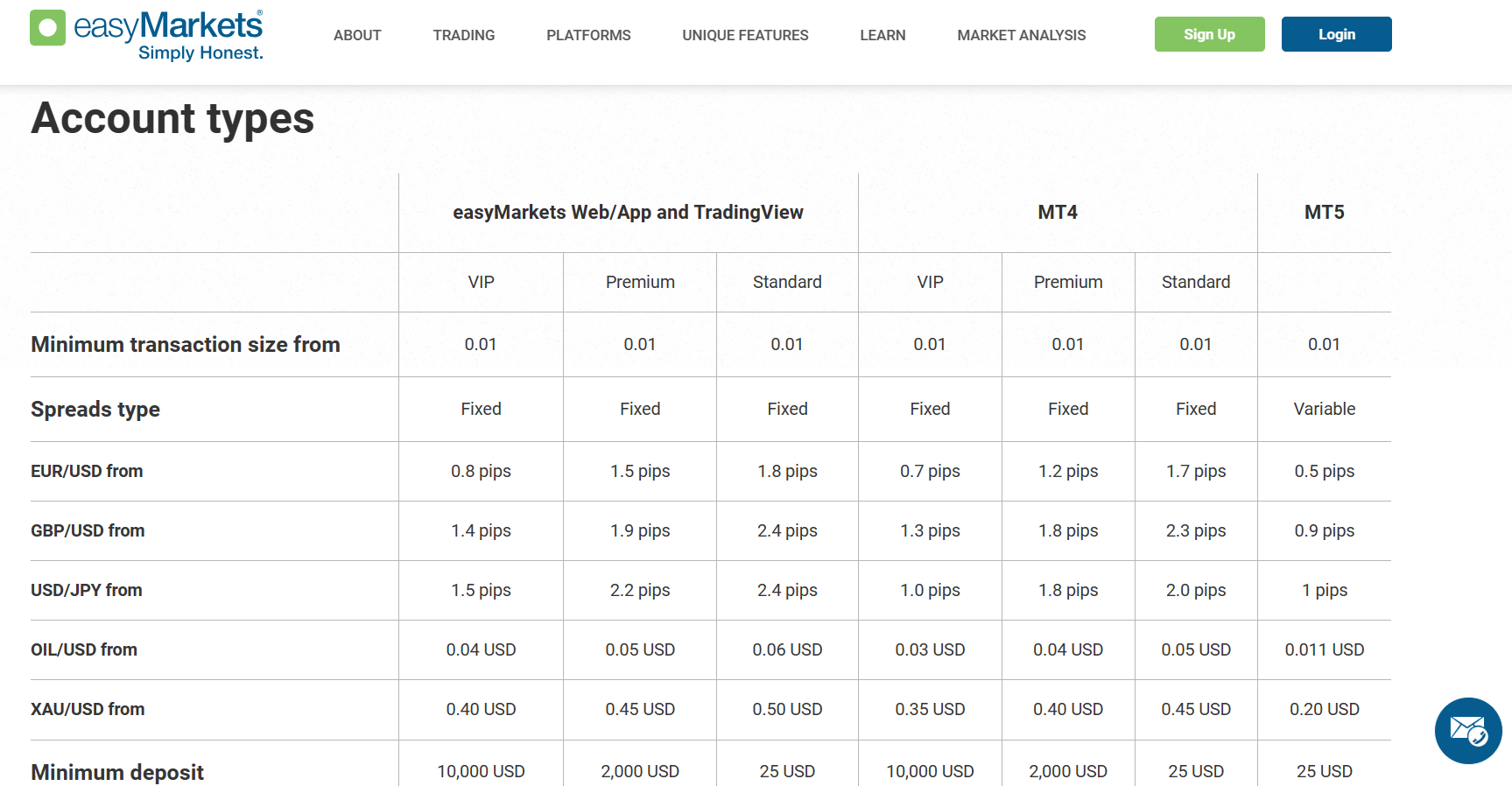

easyMarkets Account Types and Features

They offer three account types: Standard, Premium, and VIP. Each caters to different trading needs and budgets. Standard accounts are ideal for beginners, with minimum deposits of $25 and access to basic features like variable spreads and negative balance protection.

Premium accounts offer slightly tighter spreads and educational resources for more serious traders.

VIP accounts, tailored for high-volume traders, come with personalized account managers, exclusive webinars, and even tighter spreads.

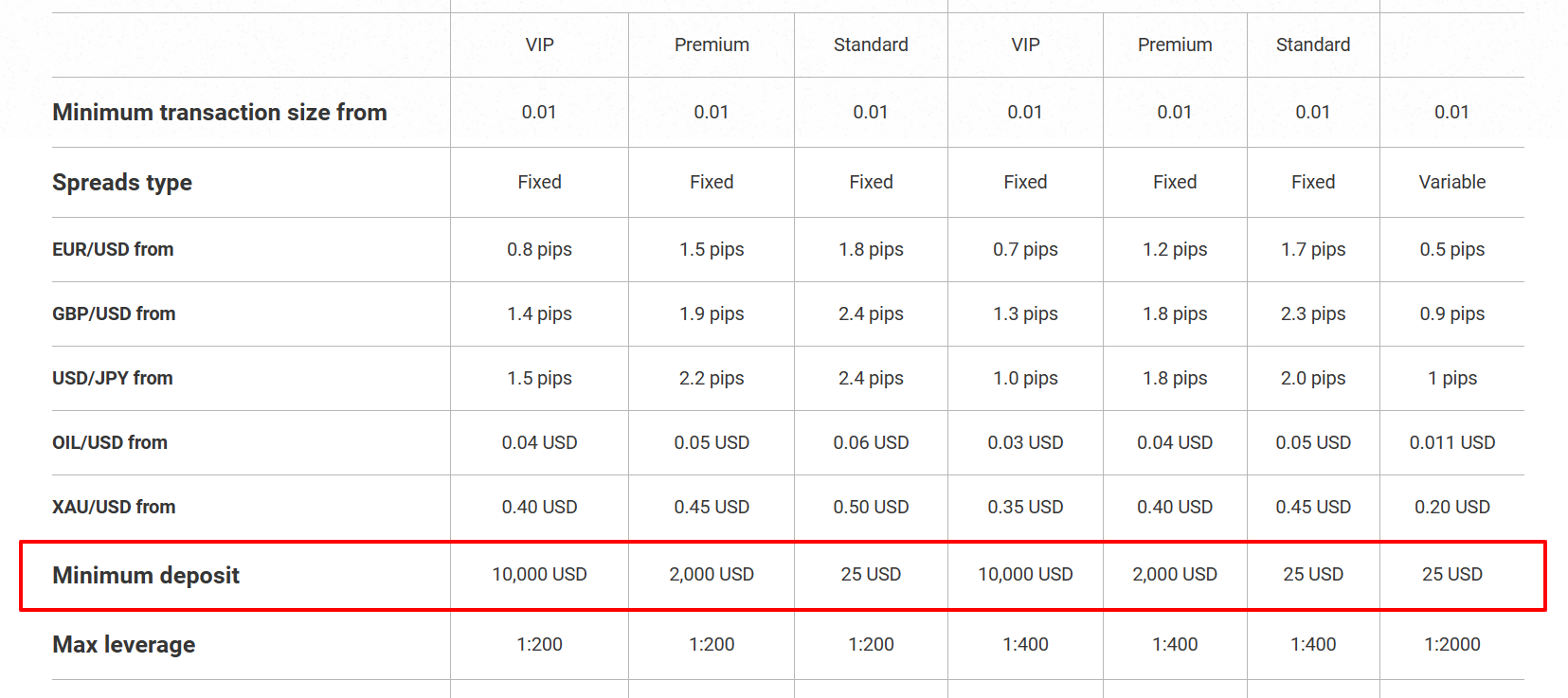

easyMarkets Minimum Deposit Requirements

This broker stands out for its low minimum deposit requirement of only $25, making it accessible to traders with limited capital. This allows individuals to get a taste of the platform and test their trading strategies before committing larger sums.

Leverage and Spreads

The leverage offered by this broker ranges from 1:200 to 1:2000, depending on the instrument and regulation. While high leverage can amplify potential profits, it also magnifies losses. Beginners should exercise caution and choose lower leverage levels to manage risk effectively.

Spreads are variable and can widen during volatile market conditions. Transparency in pricing is an area where this broker could improve, providing clearer information on potential spread variations.

How To Open An Account With easyMarkets?

Opening an account with easyMarkets is a simple process. You can do it directly through their website by providing basic personal information and completing the verification steps. The platform is available in multiple languages, making it accessible to a global audience.

How To Deposit Money In easyMarkets?

easyMarkets offers a variety of deposit methods, including debit/credit cards, bank transfers, and e-wallets like Skrill and Neteller. Processing times vary depending on the chosen method, but most deposits are reflected within 24 hours.

How To Withdraw From easyMarkets?

Withdrawing funds from this broker is equally simple. You can initiate withdrawals through the platform, ensuring they reach the same account used for deposits. Processing times may be slightly longer than deposits, typically ranging from 24-48 hours.

easyMarkets Trading Platforms

It provides three trading platforms: MetaTrader 4 & 5, and their own proprietary WebTrader. MetaTrader is a popular industry-standard platform, favored by experienced traders for its advanced features and customization options. WebTrader, on the other hand, is user-friendly and browser-based, perfect for beginners who prefer a simpler interface.

Asset Coverage

easyMarkets offers a diverse range of assets to trade, including forex pairs, CFDs on indices, commodities, cryptocurrencies, and even vanilla options. This allows traders to diversify their portfolios and find opportunities in various markets.

easyMarkets Regulation

As mentioned earlier, they are regulated by both ASIC and CySEG, two reputable financial regulatory authorities. This ensures strict adherence to industry standards and client protection measures.

- CySEC: This company is licensed by the Cyprus Securities & Exchange Commission “CySEC” (Easy Forex Trading Ltd – License Number 079/07)

- ASIC: In Australia, easyMarkets is regulated by the Australia Securities and Investments Commission “ASIC” (Easy Markets Pty Ltd – AFS License Number 246566)

- FSA: In the Republic of Seychelles by the Financial Services Authority of Seychelles “FSA” (EF Worldwide Ltd – License Number SD056)

- FSC: In the British Virgin Islands by the Financial Services Commission “FSC” (EF Worldwide Ltd – License Number SIBA/L/20/1135)

easyMarkets Fees and Commissions

easyMarkets primarily earns revenue through variable spreads. However, there are some additional fees associated with certain transactions, such as inactivity fees and withdrawal charges. It’s important to review their fee schedule thoroughly before opening an account.

Customer Support

easyMarkets offers 24/5 multilingual customer support through live chat, email, and phone. Their representatives are generally helpful and responsive, assisting with platform usage, account management, and other trading-related queries.

Educational Resources

They provide a decent selection of educational resources, catering to both beginner and experienced traders. Their video tutorials cover basic trading concepts, platform functionalities, and risk management strategies. They also offer regular webinars conducted by market experts, delving deeper into specific topics and analysis techniques. Additionally, ebooks and articles on their website provide valuable insights and market commentary.

easyMarkets Pros and Cons

| Pros | Cons |

| Low minimum deposit: $25 makes it accessible to beginners. | Variable spreads: Can widen during volatile markets. |

| Strong regulation: ASIC and CySEC provide client protection. | Limited educational resources: Compared to some competitors. |

| Unique features: Guaranteed stop-loss and negative balance protection. | Withdrawal fees: Applicable for certain methods. |

| Diverse asset coverage: Forex, CFDs, cryptos, and vanilla options. | Not suitable for scalping: Order execution speed might not be ideal. |

| Multiple trading platforms: MetaTrader 4 & 5, WebTrader. | |

| 24/5 multilingual customer support. |

easyMarkets Client Feedback and Reviews

easyMarkets enjoys a predominantly positive reputation among online reviewers. Users appreciate the low minimum deposit, user-friendly platform, and responsive customer support. However, some mention concerns about wider spreads during news events and limited educational resources compared to some competitors.

Comparison Between easyMarkets and Other Brokers

When compared to other popular brokers like eToro or IG, it offers a good alternative for beginners. Its low minimum deposit and unique risk management features make it a safe entry point. However, eToro boasts a stronger social trading community, while IG provides a wider range of research tools and educational materials. Ultimately, the best broker depends on individual needs and trading goals. You can also read the full eToro and IG reviews for better understanding.

| IG | eToro | easyMarkets | |

| Year Founded | 1974 | 2007 | 2001 |

| Regulated | Yes | Yes | Yes |

| Forex Pairs | 97 | 52 | 62 |

| Average spread | 0.98 | 1 | 0.9 |

| Proprietary Platform | Yes | Yes | Yes |

Report Any Unwanted Situation To Report Scammed Bitcoin

easyMarkets becomes one of the prominent and trustworthy brokers. They have a good reputation for satisfying their clients. But, what will happen if you get scammed by any other broker?

Report Scammed Bitcoin is a scam-reporting website, where we will provide you with a free consultation and service recommendations to help you in recovering the lost funds.

If you have lost money to companies like KuCoin, Bitfininx, or RoboForex, please report it today by the below form.

Conclusion

easyMarkets presents a compelling option for beginner and intermediate traders seeking a simple and accessible platform with unique risk management features. Its strong regulation, diverse asset coverage, and 24/5 customer support provide a reliable trading environment.