eToro is a multi-asset trading platform that offers a wide range of financial instruments to trade, including stocks, forex, commodities, and cryptocurrencies. The platform is known for its user-friendly interface, social trading features, and copy trading tools. eToro is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

Summary Table

Feature | Description |

Account types | Demo, Personal, Professional, Corporate, Islamic |

Minimum deposit | $10-$10,000 |

Leverage | Up to 1:400 |

Trading platforms | Web, mobile |

Asset coverage | Stocks, forex, commodities, cryptocurrencies |

Spreads | Competitive |

Commissions | None on stock trades |

Customer support | 24/7 live chat |

Educational resources | Webinars, tutorials, market analysis |

Company Overview

eToro was founded in 2007 and is headquartered in Israel. The company has over 20 million registered users in over 140 countries. eToro is a pioneer in social trading, which allows users to copy the trades of other experienced traders. The company also offers a variety of educational resources to help traders learn about the markets.

eToro Account Types and Features

eToro offers four account types: Demo, Personal, Professional, Corporate, and Islamic. The eToro Demo account is a free account that allows traders to practice trading without risking any real money. The most popular account type is the Professional Account.

How To Open An Account With eToro?

Opening an account with eToro is a quick and easy process. Simply visit the eToro website and click on the “Sign Up” button to go to the eToro login page. You will be asked to provide some basic information, such as your name, email address, and phone number. Once you have completed the form, you will need to verify your identity by uploading a copy of your passport or driver’s license.

How To Deposit Money In eToro?

eToro supports a variety of deposit methods, including credit cards, debit cards, bank transfers, and e-wallets. The minimum deposit amount is $10-$10,000.

How To Withdraw From eToro?

Withdrawing money from eToro is also a straightforward process. Simply log in to your account and click on the “Withdraw” button. You will be asked to enter the amount you want to withdraw and select your preferred withdrawal method. The withdrawal processing time typically takes 1-3 business days. You will be charged of $5 as a withdrawal fee.

eToro Trading Platforms

eToro offers two trading platforms: a web-based platform and an eToro mobile app. The web-based platform is a full-featured platform that offers a wide range of charting tools, indicators, and order types. The mobile app is a more streamlined platform that is designed for on-the-go trading.

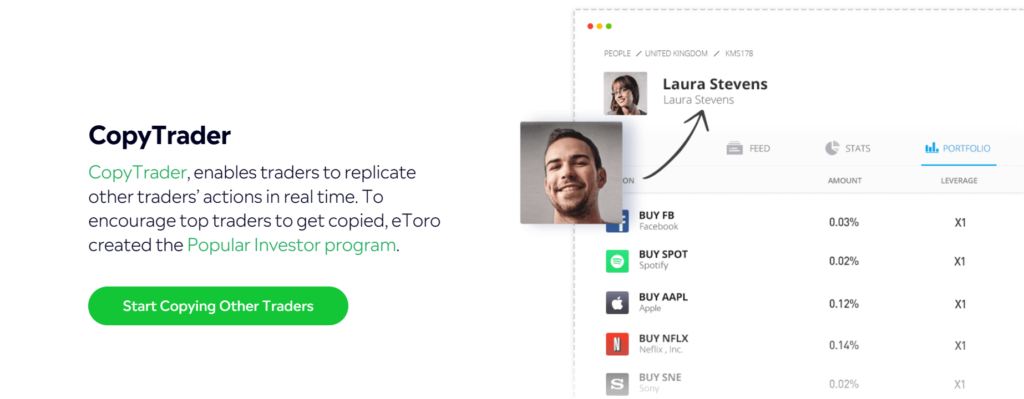

They have a unique feature of copying other successful traders. You can simply choose your favorite broker and copy the trades. To copy the trade, the minimum trade should be $200.

They have also a mobile app for Android and iOS users. Their mobile apps are user-friendly and users can do the trading on the go.

Asset Coverage

eToro offers a wide range of financial instruments to trade, including stocks, forex, commodities, and cryptocurrencies. The platform has over 3,000 stocks available to trade, as well as over 70 currency pairs, 20 commodities, and over 160 cryptocurrencies.

Regulatory Compliance and Security

e Toro is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). The company also implements a variety of security measures to safeguard client funds and personal information.

eToro Fees and Commissions

e Toro does not charge commissions on stock trades. The platform does, however, charge spreads on all trades. The spreads for major assets are typically competitive. There is also an inactive fee if you forget to log in to your account for 12 months. They will charge you $10/month until your capital runs out or you log back again.

eToro Customer Support

eToro offers 24/7 live chat customer support. The company also has a comprehensive FAQ section on its website.

Educational Resources

They offer a variety of educational resources to help traders learn about the markets. These resources include webinars, tutorials, and market analysis.

Pros and Cons

Why eToro Is Good?

- User-friendly interface

- Social trading features

- Copy trading tools

- Regulated

- Wide range of asset coverage

- 24/7 live chat customer support

Why eToro Is Bad?

- Limited asset coverage compared to some other brokers

- High leverage can be risky for inexperienced traders

eToro Reviews and Client Feedback

e Toro has a large and active community of traders, and there are many reviews and testimonials available online. Overall, e Toro is generally well-regarded by traders, with praise for its user-friendly interface, social trading features, and copy trading tools. However, some traders have expressed concerns about the high leverage offered by the platform, which can be risky for inexperienced traders.

Comparison Between eToro and Other Brokers

eToro is one of the most popular trading platforms in the world, and it competes with several other brokers. Some of the most popular eToro competitors include Pepperstone, Plus500, etc.. Each of these brokers has its strengths and weaknesses, and the best broker for you will depend on your individual needs and preferences. You can read the Plus500 and Pepeprstone broker reviews.

Feature | Pepperstone | Plus500 | eToro |

Headquarter: | Australia | UK | Israel |

Regulation: | ASIC in Australia, FCA in the UK, and BaFin in Germany | FCA | FCA in the UK, SEC in the US, and ASIC in Australia |

Type of Broker: | No Dealing Desk, Dealing Desk | Market Maker | Market Maker |

If Anything Unwanted Happens, Please Contact Us

e Toro has the best customer support and issue management team for any unwanted situation. But, sometimes things go beyond your hand. If anything such happens and you cannot get any solution, you can contact us.

Report Scammed Bitcoin is a professional scam reporting website. Through our contact form, you can submit the case and will get a free consultation and service recommendations to get help to recover the lost funds.

Conclusion

e Toro is a well-established and reputable trading platform that offers a variety of features and benefits to traders. The platform is particularly well-suited for beginners and those who are new to trading. However, it is important to be aware of the risks involved in trading and to only invest money that you can afford to lose.

If you have lost money to companies like Blackbull, Pepperstone, or Plus500, please report it today by the bellow form.