In the vast and dynamic world of forex trading, selecting the right broker is paramount to success. Forex4you has garnered attention for its diverse features, account types, and commitment to customer satisfaction. This Forex4You broker review aims to provide a comprehensive review, covering aspects such as Forex4you account types, trading platforms, regulatory compliance, fees, and client feedback.

Summary Table

Before delving into the details, let’s glance at a summary table highlighting key aspects.

| Aspect | Details |

| Account Types | Cent Fixed, Cent Pro, Classic Fixed, Classic Pro, Classic Standard |

| Minimum Deposit | $0 |

| Leverage | From 1:10 to 1:1000 |

| Spreads | 2 pips (Fixed), from 0.1-0.9 (floating) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile App |

| Asset Coverage | Forex, Commodities, Indices, Stocks |

| Regulation | FSC (British Virgin Islands) |

| Fees and Commissions | Competitive spreads, no commission on Cent accounts |

| Customer Support | 24/5 live chat, email support, phone support |

| Educational Resources | Webinars, tutorials, market analysis |

Forex4you Company Overview

Forex4you, founded in 2007, has carved a niche for itself in the forex industry. Operating under the holding company E-Global Trade & Finance Group, Inc., the broker has expanded its global presence with offices in the British Virgin Islands and Malaysia. With a focus on innovation and client satisfaction, it caters to a diverse clientele, from beginners to experienced traders.

Forex4you Account Types and Features

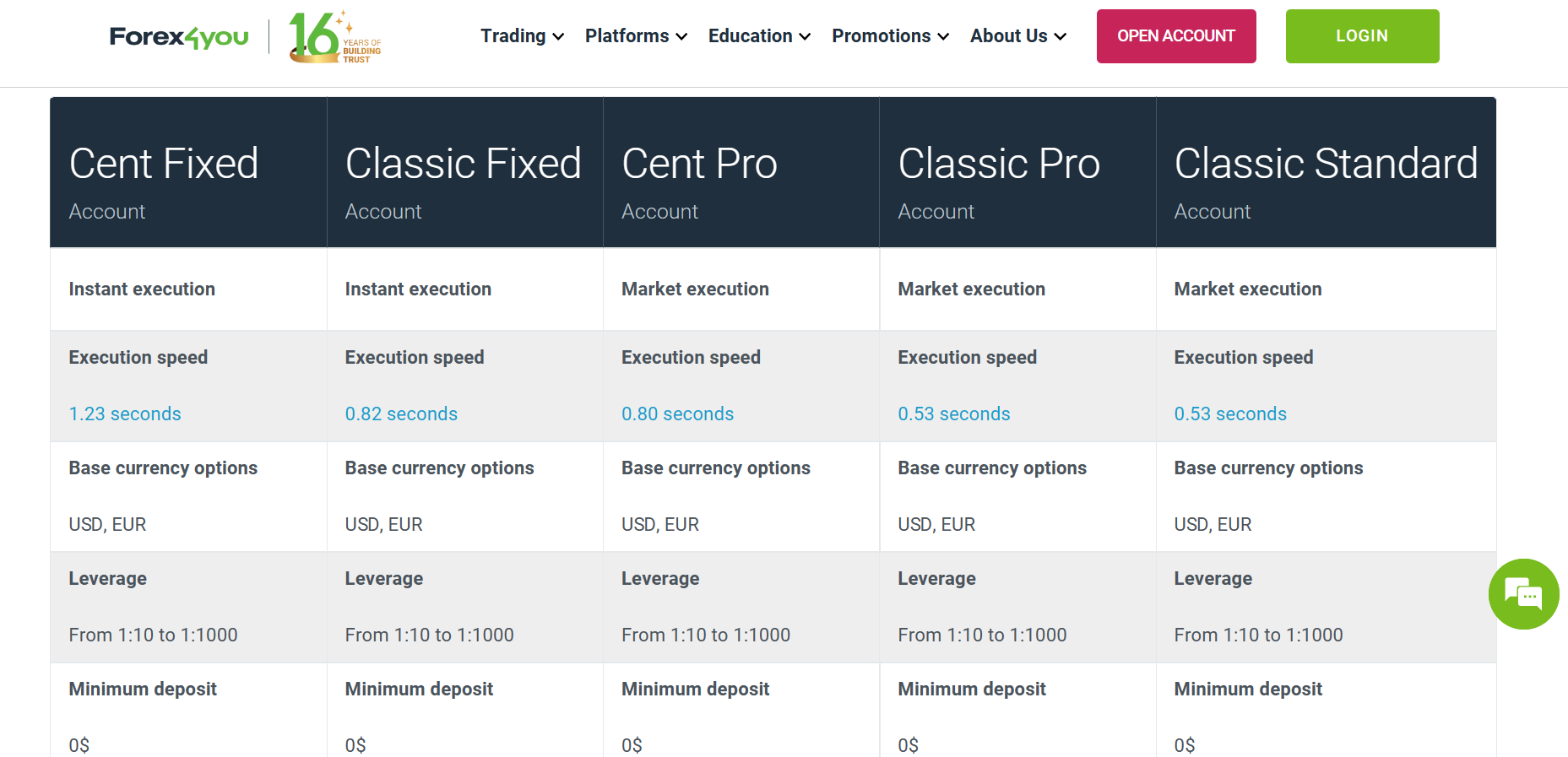

One of the strengths of this broker lies in its array of account types, catering to traders with varying preferences and experience levels. The available account types include Cent Fixed, Cent Pro, Classic Fixed, Classic Pro, and Classic Standard.

Forex4you Minimum Deposit Requirements

Forex4you stands out for its inclusive approach by offering a Cent account with a minimum deposit requirement of only $0. This low entry point makes the platform accessible to traders with varying budgets, encouraging inclusivity and diversity in its user base.

Leverage and Spreads

Leverage plays a crucial role in forex trading, amplifying potential profits and risks. Forex4you provides leverage of up to 1:1000, allowing traders to optimize their capital efficiently. However, traders need to exercise caution and fully understand the implications of high leverage.

The broker’s competitive spreads, starting from 0.1 pips, contribute to cost-effective trading. Transparent pricing is a key feature, providing traders with a clear understanding of transaction costs.

How To Open An Account With Forex4you?

Opening an account with this broker is a straightforward process. Prospective traders can visit the login page, where they will find a user-friendly interface guiding them through the registration process. The account types are clearly outlined, allowing users to choose the one that aligns with their trading goals.

How To Deposit Money In Forex4you?

This broker supports a variety of deposit methods to accommodate the diverse needs of its global clientele. Traders can fund their accounts using bank transfers, credit/debit cards, and popular e-wallets. The flexibility in deposit options enhances the overall user experience, making it convenient for traders to manage their funds.

How To Withdraw From Forex4you?

Withdrawing funds from Forex4you is as seamless as depositing. Traders can initiate withdrawals through the user-friendly interface on the platform. The broker prioritizes the timely processing of withdrawal requests, contributing to a positive user experience.

Forex4you Trading Platforms

Forex4you offers the widely acclaimed MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are known for their user-friendly interfaces, advanced charting tools, and automated trading capabilities. Whether traders are beginners or seasoned professionals, these platforms’ intuitive design and robust features enhance the overall trading experience.

Asset Coverage

Diversification is a key strategy in successful trading, and Forex4you acknowledges this by providing a wide range of tradable assets. From major and minor currency pairs to commodities, indices, and stocks, the broker ensures that traders can access diverse markets, allowing them to explore various opportunities.

Forex4you Regulation

Regulatory compliance is a critical factor in evaluating the credibility of a forex broker. This broker operates under the regulation of the Financial Services Commission (FSC) in the British Virgin Islands. While this regulatory body may not be as stringent as some others, it provides a level of oversight and ensures that the broker adheres to certain standards.

Fees and Commissions

Forex4you adopts a transparent fee structure, with competitive spreads and no commissions on Cent accounts. The absence of commissions on certain account types can be advantageous for traders, especially those who prefer a straightforward fee model without additional transaction costs.

Customer Support

Quality customer support is a cornerstone of a reliable brokerage. Forex4you excels in this aspect, offering 24/5 live chat support, email assistance, and phone support. The responsive customer service team contributes to a positive overall experience for traders, ensuring that their queries and concerns are addressed promptly.

Educational Resources

Education is empowering in the forex market, especially for newcomers. Forex4you recognizes this and provides a range of educational resources, including webinars, tutorials, and market analysis. These resources equip traders with the knowledge and skills needed to make informed decisions in the dynamic world of forex trading.

Pros and Cons

| Pros | Cons |

| Low minimum deposit | Limited choice of trading platforms |

| Diverse account types | Regulatory oversight may vary |

| Competitive spreads | Limited asset coverage for stocks |

| High leverage options | |

| Transparent fee structure | |

| Responsive customer support | |

| Educational resources for traders |

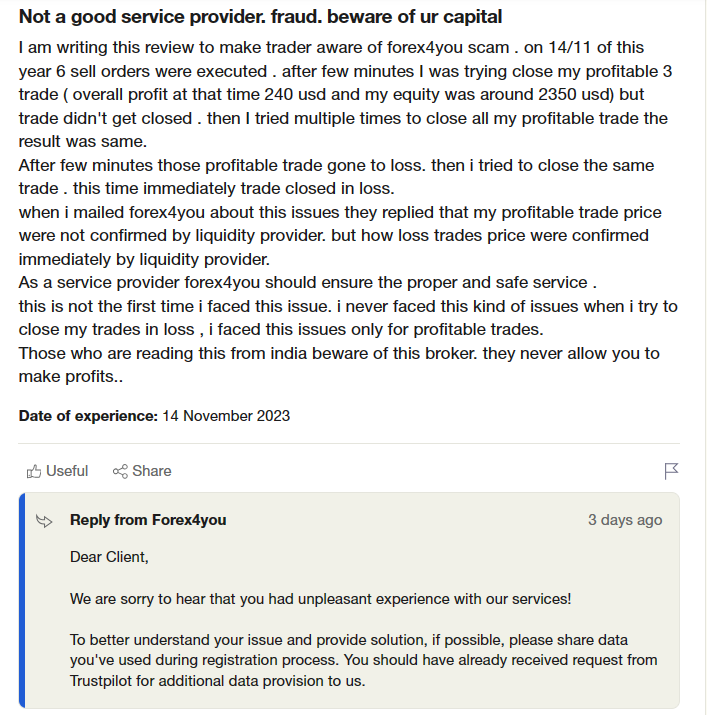

Forex4you Client Feedback and Reviews

Understanding the experiences of existing clients is crucial in assessing the reliability of a broker. Online reviews of Forex4you generally highlight the broker’s user-friendly interface, low minimum deposit requirements, and responsive customer support. However, some users express concerns about the limited choice of trading platforms and variations in regulatory oversight.

Comparison Between Forex4you and Other Brokers

When choosing a forex broker, it’s crucial to compare them based on your specific needs and priorities. Here’s a quick comparison of Forex4you with two popular competitors:

| Feature | Forex4you | XM | IG |

| Regulation | CySEC (Tier-3) | ASIC (Tier-1) | FCA (Tier-1) |

| Minimum Deposit | $0 | $50 | $300 |

| Spreads | Variable, from 0.6 pips | Variable, from 0.7 pips | Variable, from 0.6 pips |

| Leverage | Up to 1:1000 | Up to 1:888 | Up to 1:200 |

| Commission | Yes (only for Cent Pro and Classic Pro accounts) | No | Yes (on CFDs) |

| Platforms | MetaTrader 4 & 5, WebTrader, Mobile App | MetaTrader 4 & 5, WebTrader, Mobile App | MetaTrader 4 & 5, WebTrader, Mobile App |

| Education | Webinars, video tutorials, glossary, market analysis | Webinars, video tutorials, glossary, market analysis | Webinars, video tutorials, glossary, market analysis |

If You Face Any Problem, Contact Report Scammed Bitcoin

Report Scammed Bitcoin is a scam reporting website where you can submit your scam victim case if you have been the victim of any scam broker company. You will get a free consultation from our professionals. In this call, you will get some professional guidance and recovery service recommendations to help you recover the lost funds.

If you have lost money to companies like KuCoin, Bitfininx, or RoboForex, please report it today by the below form.

Final Thought

Forex4you has positioned itself as a reputable broker, offering a diverse range of account types, competitive spreads, and user-friendly platforms. Its commitment to inclusivity, with a low minimum deposit requirement, makes it an attractive option for traders with varying budgets. While there are some concerns regarding the choice of trading platforms and regulatory oversight, Forex