IFC Markets is a prominent international broker offering access to a diverse range of financial instruments. This review delves into their strengths and weaknesses, helping you determine if they align with your trading goals.

Summary Table

| Feature | Description |

| Company Overview | Established in 2006, regulated by CySEC & BVI FSC |

| Account Types | Standard, Beginner, Demo |

| Minimum Deposit | $1-$1000 (Based on account types) |

| Leverage | Up to 1:400 (Micro), Varies (Others) |

| Platforms | NetTradeX, MetaTrader 4/5 |

| Assets | Forex, commodities, indices, cryptocurrencies |

| Spreads | 0-1.8 pips |

| Fees | Commissions on some accounts, spreads |

| Education | Webinars, tutorials, articles |

| Customer Support | 24/7 multilingual support |

Company Overview

Founded in 2006, IFC Markets boasts a strong presence in Europe and beyond, regulated by CySEC and the BVI FSC. They cater to various traders, from beginners to seasoned professionals.

Account Types and Features

We discovered that IFC Markets offers three different account types: Standard, Beginner, and Demo. These accounts have balances in USD, EUR, JPY, and uBTC, making transfers simple and available with either fixed or variable spreads for each trading platform. Better terms and a reduction in the maximum leverage to 1:200 are provided by a higher-grade account, which needs deposits starting at $1,000.

The IFCM free Demo account is meant for research purposes or as a functioning tool to test tactics. It runs on virtual money.

In addition, you could be granted VIP membership, which entitles you to many benefits like commission-free deposits and withdrawals, unique personal instruments, flexible trading conditions, and free VPS access.

How To Open An Account:

The process is straightforward:

- Visit the IFC Markets website and click “Open Account.”

- Choose your preferred account type and fill out the online application.

- Verify your identity and submit the required documents.

- Fund your account using various methods, including bank transfers, e-wallets, and credit cards.

How To Deposit Money?

IFC Markets supports various deposit methods, including bank wires, credit/debit cards, and e-wallets, with varying processing times and fees.

How To Withdraw From IFC Markets:

Withdrawals are generally processed within 1-2 business days, depending on the chosen method. Fees might apply based on the chosen method.

Trading Platforms

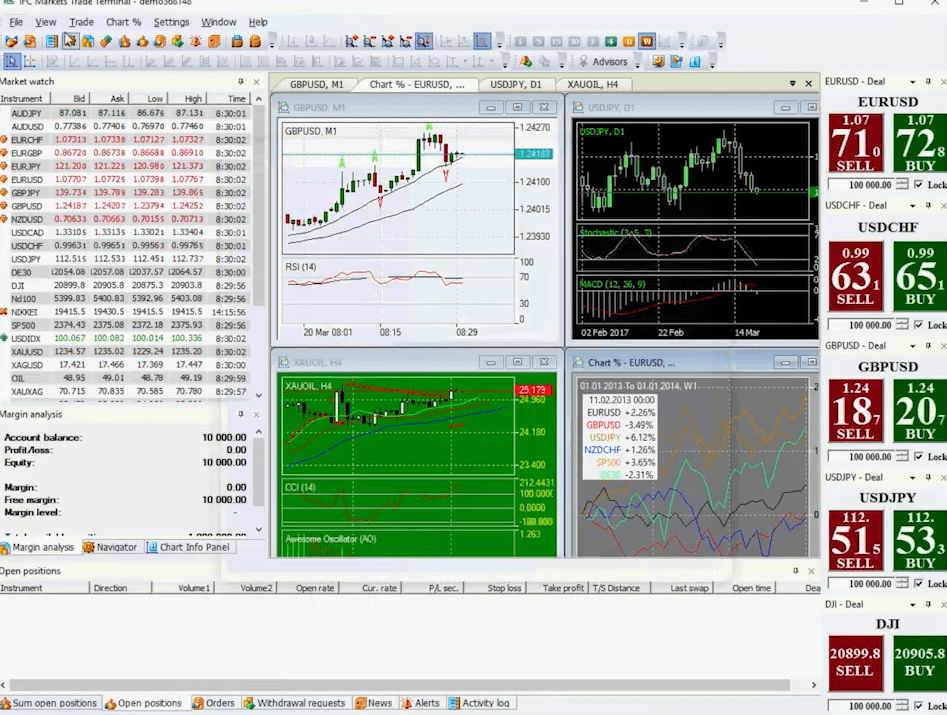

We observed that the broker offers a variety of trading platforms, including the well-liked MetaTrader4 and MetaTrader5, and that IFCM holds permission to use the cutting-edge trading platform NetTradeX.

Desktop Platform

Most likely, there isn’t much need to introduce the industry leaders, MT4 and sophisticated MT5, as these platforms offer a wide range of trading options, trading automation, and a MultiTerminal.

Using NeTradeX, a cutting-edge trading platform that is ideal for experienced traders and offers the ability to trade using special GeWorko Method features like creating custom instruments and portfolio trading, is an additional choice. The selection of instruments includes both conventional ones and expertly crafted synthetic ones, as well as the option to build your own.

Web Platform

Platforms are accessible via the web as well, albeit they offer fewer features and a more complete toolset than those found on desktops. In the meantime, it is worthwhile to take into consideration and useful for basic trading methods and monitoring.

Trading Platform for Mobile Devices

Another fantastic advantage is the ability to use the platforms on other devices, such as iOS and Android mobile applications.

Asset Coverage

- Forex: Major, minor, and exotic pairs with low spreads and deep liquidity.

- Commodities: Metals, energies, and agricultural products available for CFD trading.

- Indices: Global indices like the S&P 500 and FTSE 100.

- Cryptocurrencies: Major coins and altcoins with competitive spreads and leverage.

Regulatory Compliance and Security

The British Virgin Islands Financial Services Commission (BVI FSC) has registered and licensed IFC Markets, which is run by a well-established group that is incorporated in the BVI. In general, offshore brokers are viewed as having less potential in terms of regulatory standing. That being said, IFC Markets has further incorporated IFCM CYPRUS LIMITED, a Cyprus Investment Firm that is licensed by the BVI FSC, LFSA, and CySec.

Because of this extra regulation, IFC Markets is now a safe broker. CySEC is a European body that oversees the company’s entire investing operations and requires stringent compliance.

As a CySec, BVI, FSC, and LFSA broker, IFCM Cyprus Limited conforms with the European Commission’s MiFID regulations and is permitted to offer investment services inside the European Economic Area. It is also a member of the Investor Compensation Fund (ICF). In addition to using participation plans and segregating client funds, the business also maintains professional indemnity insurance for financial institutions.

Fees and Commissions

Bank liquidity providers move their clients’ orders to the interbank market automatically, and IFC Markets provides a pricing model. IFC offers commission-free trading with tight spreads and no additional fees. The broker does not impose any fees on withdrawals either, although it does impose a deposit fee.

Additionally, always keep in mind the rollover or overnight fee, which is levied on positions maintained for more than a day and depends on whether you are purchasing or selling instruments. Quotes are billed or reimbursed according to the precise measure specified on each instrument; the above table serves as an example.

Customer Support

- 24/7 multilingual support via phone, live chat, and email.

- Dedicated account managers for higher-tier clients.

- Generally positive feedback regarding responsiveness and professionalism.

Educational Resources

- Extensive library of webinars, video tutorials, and articles.

- Beginner-friendly courses and advanced trading strategies are covered.

- Demo accounts are available for practicing before risking real capital.

Pros and Cons

Pros:

- Diverse account types to suit various needs and experience levels.

- Advanced trading platforms with powerful features.

- Wide range of assets, including exotic forex pairs and cryptocurrencies.

- Strong regulatory compliance and security measures.

- 24/7 customer support and comprehensive educational resources.

Cons:

- Minimum deposit requirements for some accounts might be high for beginners.

- Commissions on certain accounts can add to trading costs.

- Spreads, though generally low, can widen during volatile market conditions.

IFC Markets Reviews and Client Feedback

Overall, client feedback is positive, with traders commending the platform’s functionality, asset selection, and educational resources. However, some mention occasional issues with withdrawal processing and platform stability.

Comparison Between IFC Markets and Other Brokers

When compared to peers, IFC Markets stands out with its proprietary platform, diverse asset coverage, and focus on algorithmic trading. However, some competitors might offer lower minimum deposits or tighter spreads on specific asset classes. Check the below short comparison between IFC Markets, Plus500, and OctaFX. You also can check our individual Plus500 and OctaFX reviews.

| Compare | IFC Markets | Plus500 | OctaFX |

| Regulations | CySEC, BVI FSC | FCA | CySEC, FCA, ASIC |

| Trading Desk Types | ECN, No dealing desk, STP | Market Maker | Market Maker, No dealing desk, STP |

| Demo account | Yes | Yes | Yes |

| Number of Currency Pairs | 49 | 50 | 32 |

If Anything Unwanted Happens, Contact Us

While IFC Markets generally boasts a positive reputation, unforeseen issues can arise. If you encounter any problems, such as:

- Difficulties with account opening or verification.

- Delays in deposit or withdrawal processing.

- Platform malfunctions or technical glitches.

- Discrepancies in account statements or trade executions.

- Unsatisfactory customer support experiences.

Don’t hesitate to contact IFC Markets directly. Their customer support team is available 24/7 through various channels:

We, Report Scammed Bitcoin are always here to help you in any case of any broker issue whether you are scammed or need professional advice to choose the perfect broker. We provide free consultation on financial cases and also recommend fund recovery services to help you recover the funds.

If you have lost money to companies like KuCoin, Bitfininx, or RoboForex, please report it today by the below form.

Conclusion

IFC Markets presents a compelling option for traders seeking a versatile platform, robust asset selection, and advanced tools. Their commitment to education and customer support further strengthens their position. However, understanding potential drawbacks like variable fees and occasional platform hiccups is crucial for informed decision-making. Ultimately, weigh your individual needs and priorities against IFC Markets’ offerings to determine if they align for a successful trading journey.