BCR is a CFD and Forex broker established in 2009. Operating under dual regulation (ASIC and BVI-FSC), it caters to international clients with a focus on the Australian market. This review will delve into BCR’s offerings, analyzing its features, strengths, and weaknesses to help you determine if it’s the right fit for your trading needs.

Summary Table

Feature | Key Points |

Regulation | ASIC (Australia), BVI-FSC (British Virgin Islands) |

Account Types | Standard, Advantage, Alpha, and Affiliate |

Minimum Deposit | $300 (Standard, Advantage, Alpha), $3000 (Affiliate) |

Leverage | Up to 1:400 |

Spreads | From 1.7 Pips (Standard, Affiliate), 0.0 (Alpha), 1.2 (Advantage) |

Platform | MT4, MT5, WebTrader |

Assets | Forex, CFDs on stocks, indices, commodities |

Fees | $3 only for Alpha account |

Customer Support | Live chat, email, phone (limited hours) |

Education | Webinars, market analysis, video tutorials |

BCR Company Overview

BCR boasts a long history in the industry, initially focusing on Forex before expanding into CFDs. Known for its straightforward approach and transparency, BCR prioritizes regulatory compliance and risk management. However, its limited asset selection and reliance on a single platform (MT4) might hinder more advanced traders.

BCR Account Types and Features

BCR offers 4 types of accounts: Standard, Alpha, Advantage, and Affiliate

BCR Minimum deposit requirements

The low $300 minimum for the Standard account makes it accessible to new traders. However, only an Affiliate account needs a $3000 minimum investment amount.

Leverage and Spreads

Leverage varies based on the asset and account type, although 1:400 is the maximum offered. Spreads are competitive for the Standard account but can be wider on the Standard and Affiliate accounts.

How To Open An Account With BCR?

Opening an account is straightforward

- Visit the BCR login page and click the “Register” button.

- Complete the online application form.

- Verify your identity and residency documents.

- Fund your account.

- Start trading!

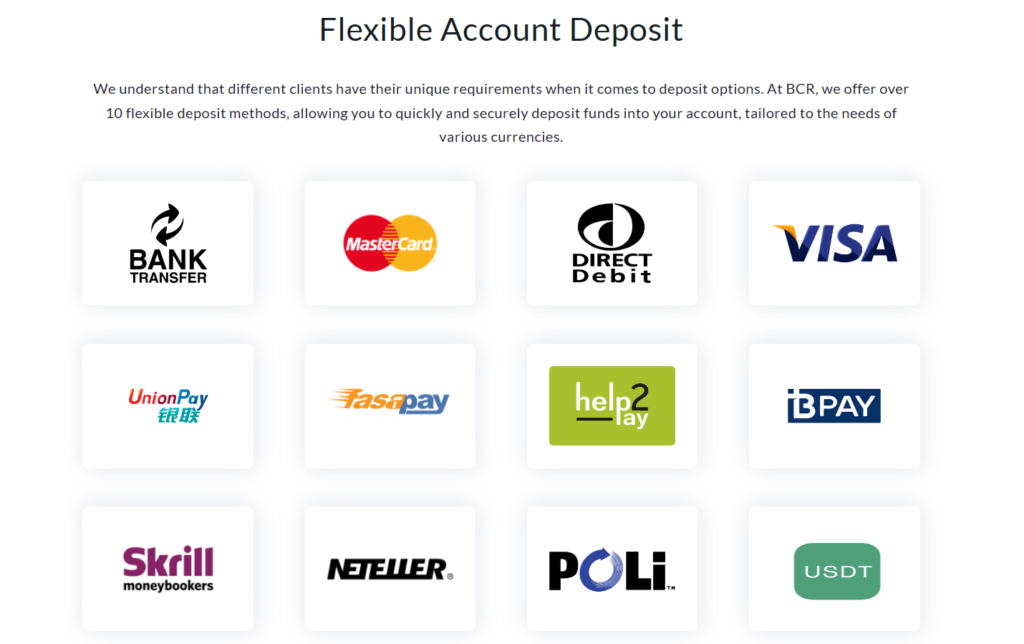

How To Deposit Money In BCR?

BCR offers various deposit methods including bank wire, credit/debit cards, and e-wallets. Fees may apply depending on the chosen method.

How To Withdraw From BCR?

Withdrawals are typically processed within 24 hours and incur no fees. The same verification documents used for deposits are required.

BCR Trading Platforms

BCR relies solely on MetaTrader 4, a popular platform but considered outdated by some advanced traders who prefer newer options with more features. Also, they offer MT5 and their own WebTrader platform too.

Asset Coverage

BCR’s asset selection is decent, focusing mainly on Forex pairs, with CFDs on popular stocks, indices, and commodities. However, compared to some competitors, the variety is on the narrower side.

BCR Regulation

BCR’s dual regulation under ASIC and BVI-FSC provides a layer of security and confidence for traders. Both regulators are respected for their strict guidelines and consumer protection measures.

In Australia, “BCR” is a registered business name of Bacera Co Pty Ltd, Australian Company Number 130 877 137, Australian Financial Services Licence Number 328794.

Fees and Commissions

The Standard account is commission-free, while the Alpha account charges a $3 fee per lot traded, adding to the variable spreads. Other fees like inactivity charges and currency conversion fees apply.

Customer Support

Customer support is available via live chat, email, and phone (limited hours). While user reviews report efficient responses, the lack of 24/7 phone support might be a drawback for some clients.

Educational Resources

BCR offers educational resources like webinars, market analysis, and video tutorials. However, compared to some brokers with comprehensive learning centers, the selection is more limited.

BCR Pros and Cons

Pros | Cons |

Regulated by ASIC and BVI-FSC | Limited asset selection |

Transparent fee structure | Commission fees on the Alpha account |

Competitive spreads on Standard account | |

Low minimum deposit for Standard account | |

Educational resources available |

BCR Client Feedback and Reviews

Client feedback is mixed, with praise for BCR’s transparency and regulation balanced against complaints about wider spreads. But, mostly the clients are happy with BCR trading.

BCR vs. Other Brokers Comparison Table

Feature | BCR | FXTM | Pepperstone |

Regulation | ASIC, BVI-FSC | ASIC, FCA, ASIC (US) | |

Account Types | Standard, Alpha, Advantage, Affiliate | Standard, ECN, Micro, Shares | Standard, Razor (ECN), Active Traders |

Trading Platform | MT4, MT5, WebTrader | MT4, MT5 | MT4, MT5, Pepperstone Edge |

Asset Coverage | Forex, CFDs on stocks, indices, commodities | Forex, CFDs on stocks, indices, commodities, cryptocurrencies, ETFs | Forex, CFDs on stocks, indices, commodities, cryptocurrencies, ETFs, options |

Fees & Commissions | Standard (commission-free), Alpha ($3 per lot + spreads) | Commissions on all accounts (variable based on account type) | Commissions on all accounts (generally lower than BCR Alpha) |

Minimum Deposit | $300 (Standard), $3000 (Affiliate) | $100 | $200 (Standard), $0 (Razor) |

Leverage | Up to 1:400 | Up to 1:300 | Up to 1:500 |

Spreads | 0.0 to 1.7 | Variable | Variable |

Customer Support | Live chat, email, phone (limited hours) | 24/7 live chat, phone, email | 24/7 live chat, phone, email |

Educational Resources | Webinars, market analysis, video tutorials | Webinars, market analysis, video tutorials, eBooks | Webinars, market analysis, video tutorials, articles |

Pros | Transparent fee structure, competitive spreads (Standard), low minimum deposit | Wider asset selection, 24/7 support, multiple platforms | Wider asset selection, multiple platforms, lower commissions (Razor) |

Cons | Limited asset selection, single platform, limited support hours | Commissions on all accounts, no advanced features | No commission-free option, higher leverage limit |

Contact Report Scammed Bitcoin For Any Help

You can find many scam brokers who are imposters of BCR with their names and logos. should be aware of them. If you think, you did a wrong step or started working with the wrong BCR company, you can contact us.

Our professionals will provide you with a free consultation call. In this call, they will analyze whether the company is a fake BCR or a real one. Also, if you think you have been scammed by any other broker or the fake BCR broker, we can recommend some recovery companies to help you with that.

Final Thought

BCR is a decent option for beginner and intermediate traders seeking a basic and transparent platform with competitive spreads on a Standard account. However, its limited asset selection, reliance on MT4, and lack of advanced features might be deal-breakers for some. If you prioritize a wider range of assets, multiple platforms, or 24/7 phone support, consider exploring competitors like FXTM or Pepperstone. Ultimately, the best broker depends on your individual trading needs and preferences.