Plus500 is a global online trading platform that offers Contracts for Difference (CFDs) on a wide range of financial instruments, including shares, commodities, indices, and cryptocurrencies. Founded in 2008, Plus500 has established itself as a leading provider of CFD trading services, catering to both novice and experienced traders worldwide.

Summary Table

Feature | Description |

Company | Plus500 Ltd |

Founded | 2008 |

Headquarters | London, UK |

Regulated | FCA, ASIC, CySEC, FSCA |

Trading Instruments | CFDs on shares, commodities, indices, and cryptocurrencies |

Trading Platforms | WebTrader, Mobile App |

Minimum Deposit | Varies by region |

Leverage | Up to 1:300 |

Customer Support | 24/7 via live chat, email, and phone |

Company Overview

Plus500 is a publicly traded company listed on the London Stock Exchange’s Main Market. The company is regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa.

Plus500 Account Types and Features

Plus500 offers a variety of account types to suit different trading needs and experience levels. These include:

- Plus500 Invest: The Plus500 Invest account is designed for investors who manage unleveraged equities portfolios and have access to 17 exchanges in the United States and Europe. Unfortunately, access is limited by geography. The equity exchange determines the costs; however, Plus500 offers cheap minimums ranging from €2.00 to €6.00, while brokerage commissions are $0.006 per share in the US or 0.045% for the majority of markets.

- Plus500 CFD: The Plus500 CFD account is the default account option, open to all clients (Plus500 has traders from over 50 countries). It lists every trading instrument; but, due to legal restrictions on certain assets, such as cryptocurrency, availability may differ. Plus500 launches its easy-to-use mobile app and web-based trading platform, while it does not allow algorithmic or duplicate trading. It has features like quick order execution and analytics depending on customer behavior.

- Plus500 Futures: The Plus500 Future account is available for US-based clients only, offering futures trading and clearing solutions for assets from seven exchanges. The trading platform features an add-on service allowing traders to select options trading access. Futures trading at Plus500 occurs through Cunningham Commodities LLC, a registered futures commission merchant.

How To Open An Account With Plus500?

Here is the step-by-step process of opening an account with Plus500:

- To begin trading, go to the Plus500 website and click the blue “Start Trading Now” button to go to the Plus500 login page.

- All traders need to do in the first step is provide their email address and password. Additionally, traders can register at Plus500 using their Apple, Facebook, or Google accounts.

- Traders cannot verify their accounts unless they have completed an application process.

- It is required for traders to pass account verification before they may deposit money, trade, or withdraw money from Plus500. Most will validate their Plus500 account types and fulfill AML/KYC criteria after providing one proof of residency document and a copy of their government-issued ID.

- To finish the registration and setup process, you must make at least the Plus500 minimum deposit of $100 or the equivalent in another currency. Additionally, Plus500 will email a confirmation that contains account login information.

How To Deposit Money In Plus500?

Plus500 supports a variety of deposit methods, including credit/debit cards, e-wallets, and bank transfers. The minimum deposit amount varies by region but the Plus500 minimum deposit amount typically ranges from $100 to $200.

How To Withdraw From Plus500?

Withdrawals from Plus 500 are generally processed within 24 hours, with the exact timeframe depending on the chosen withdrawal method. The withdrawal process is secure and requires identity verification to ensure the safety of client funds.

Trading Platforms

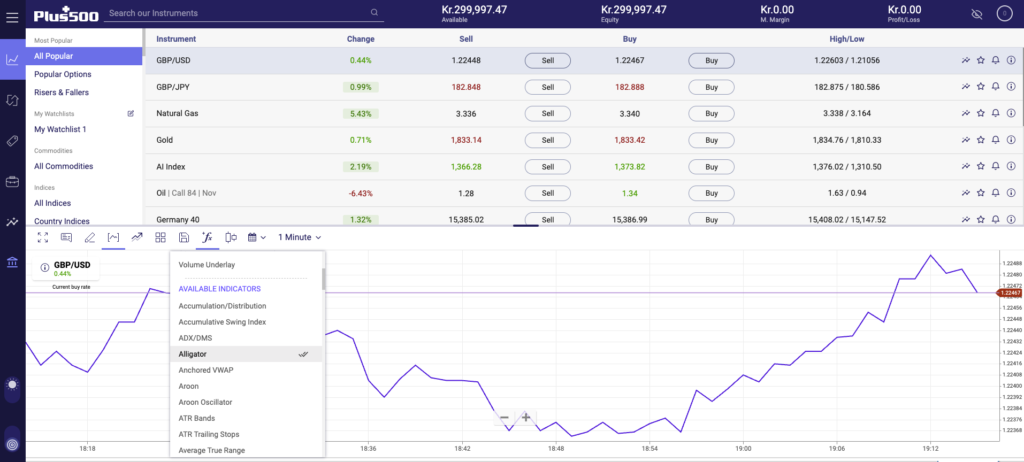

Plus500 offers two primary trading platforms:

- Plus500 WebTrader: A user-friendly web-based platform with advanced charting tools and technical indicators.

- Plus500 Mobile App: A mobile trading app available for iOS and Android devices, providing access to real-time market data and trading functionality on the go.

Here is the downside of Plus 500 regarding the trading platforms. Other reputable brokers are using popular trading platforms like Mt4, MT5, cTrader, or CopyTrader. But Plus500 has a minus point in this sector.

Asset Coverage

Plus 500 offers a diverse range of financial instruments for CFD trading, including indices, forex, commodities, crypto, shares, options, and ETFs.

- Forex – more than sixty major, minor, and exotic currency pairs, such as EUR/USD, GBP/USD, and EUR/NZD

- Indices – 30+ country, ESG, and sector index funds such as the USA 30, Europe 50, France 40, FTSE 100, Japan 225, NASDAQ 100, IBEX 35, Metaverse Giants, and NFT Giants

- Commodities – 24 agricultural, energy, and precious metal products such as copper, natural gas, oil, and wheat

- Shares – Over 1800 stocks from LVMH, Amazon, Apple, Tesla, Rolls-Royce, and Lloyds Banking Group.

- Options: More than 200 widely used instruments are available as contracts for these instruments; examples include the Europe 50 index, natural gas, EUR/USD, and Deutsche Bank.

- ETFs: more than ninety exchange-traded funds, including the PowerShares QQQ Trust ETF, Commodity Index Fund, and iShares Silver

- Cryptocurrency – 15 crypto coins, including Bitcoin, Ripple, Litecoin, and Ethereum, as well as the Crypto 10 index

Regulatory Compliance and Security

Plus500 is committed to maintaining the highest standards of regulatory compliance and security. The company is regulated by multiple financial authorities and implements robust measures to protect client funds and personal information. These measures include:

- Segregated client funds: Client funds are kept separate from the company’s operational funds.

- Data encryption: All client data is encrypted to safeguard sensitive information.

- Regular audits: Plus500 undergoes regular audits to ensure compliance with regulatory requirements.

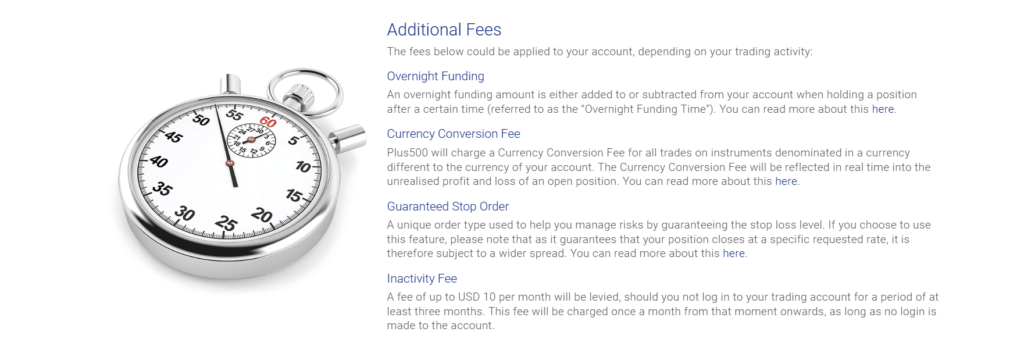

Fees and Commissions

Plus 500’s fee structure is competitive and transparent. The company primarily charges spreads, which are the difference between the buy and sell prices of an asset. Spreads vary depending on the traded asset and market conditions.

They don’t charge any fee for withdrawing funds. Also, they impose a small amount of $10/month as an inactivity fee.

Customer Support

Plus 500 provides 24/7 customer support through live chat, email, and phone in multiple languages. The company’s customer support team is knowledgeable responsive, helping minded.

Educational Resources

Plus500 offers a comprehensive suite of educational resources to help traders of all levels improve their knowledge and skills. These resources include:

- Trading Academy: A comprehensive online learning platform with video tutorials, articles, and interactive courses.

- Webinars: Live and on-demand webinars covering various trading topics and strategies.

- Glossary: A comprehensive glossary of financial terms and concepts.

Pros and Cons

Pros:

- Wide range of financial instruments for CFD trading

- User-friendly trading platforms

- Robust risk management tools

- Competitive fees and commissions

- 24/7 customer support

- Comprehensive educational resources

Cons:

- Limited availability of certain asset classes, such as mutual funds and ETFs

- Potential for high losses due to the leveraged nature of CFD trading

Plus500 Reviews and Client Feedback

Plus500 has received generally positive feedback from its clients, with many praising the platform’s ease of use, wide range of instruments, and responsive customer support. However, some clients have expressed concerns about the potential for high losses due to the leveraged nature of CFD trading.

Comparison Between Plus500 and Other Brokers

Till now you have read our Plus 500 broker review. Now, let’s compare it with two other brokers which we already reviewed in other articles. You can read the Pepperstone and eToro reviews for more details.

Feature | Pepperstone | Plus500 | eToro |

Headquarter: | Australia | UK | Israel |

Regulation: | ASIC in Australia, FCA in the UK, and BaFin in Germany | FCA | FCA in the UK, SEC in the US, and ASIC in Australia |

Type of Broker: | No Dealing Desk, Dealing Desk | Market Maker | Market Maker |

Report Scammed Bitcoin For Any Unwanted Situation

Report Scammed Bitcoin is a scam reporting website, where a victim can report their scam report and they will get a free consultation and service recommendations to get the proper help in recovering the lost funds.

Though Plus 500 is a legit broker and there is nothing to fear, if anything unwanted happens with this broker or any other broker, without any delay, contact us. We are always here to help you.

Conclusion

Plus 500 is a reputable and well-established CFD broker that offers a comprehensive trading experience for both novice and experienced traders. The company’s wide range of asset classes, user-friendly platforms, robust risk management tools, and competitive fees make it an attractive option for many traders. However, it is crucial to carefully consider the risks involved in CFD trading and ensure that this type of trading aligns with one’s financial goals and risk tolerance.

If you have lost money to companies like BitForex, Blackbull, or Pepperstone, please report it today by the below form.