Robinhood has emerged as a prominent player in the online brokerage landscape, revolutionizing the way individuals approach investing. Its user-friendly interface, commission-free trading, and focus on fractional shares have attracted a large and enthusiastic user base.

However, before diving into the world of Robinhood, it’s crucial to conduct a thorough assessment of its features, offerings, and potential drawbacks. This comprehensive review will delve into the intricacies of Robinhood, providing a detailed analysis of its account types, trading platforms, asset coverage, regulatory compliance, fees, customer support, educational resources, client feedback, and comparison with other brokers.

Summary Table

| Feature | Description |

| Account Types | Margin account, Cash account |

| Minimum Deposit | None |

| Trading Platforms | Web platform, mobile app |

| Asset Coverage | Stocks, ETFs, options, cryptocurrencies |

| Regulatory Compliance | FINRA-regulated, SEC-registered |

| Fees | Commission-free trading, no account fees |

| Customer Support | Email, phone, chat |

| Educational Resources | Learning center, webinars, tutorials |

| Pros | User-friendly interface, commission-free trading, fractional shares |

| Cons | Limited research tools, lack of customer support |

Company Overview

Founded in 2013, Robinhood has embarked on a mission to democratize finance, making investing accessible to everyone. With its sleek design, intuitive interface, and focus on commission-free trading, Robinhood has captured the attention of a younger generation of investors. The company has grown rapidly, amassing over 22 million users and managing over $322 billion in assets under management.

Robinhood Account Types and Features

Robinhood offers two main account types: Margin and Cash accounts. Margin accounts offer several advantages over Cash accounts, including the ability to trade with unsettled funds, access margin investing, and Level 3 options trading. However, Margin accounts also come with some risks, such as pattern day trading regulations and the potential for margin calls. Cash accounts, on the other hand, are not subject to pattern day trading regulations and do not allow trading with unsettled funds. However, Cash accounts also have some limitations, such as the inability to roll options.

| Account name | Unlimited day trades | Access margin investing | Access level 3 options trading | Trade with unsettled funds from stock and options sales |

| Margin accounts | ❌ | ✅ | ✅ | ✅ |

| Cash accounts | ✅ | ❌ | ❌ | ❌ |

How To Open An Account With Robinhood?

Opening an account with Robinhood is a straightforward process. Simply visit the Robinhood website or download the mobile app. Provide your personal information, link your bank account, and complete the verification process. Once approved, you can start investing immediately.

How To Deposit Money In Robinhood?

Robinhood supports a variety of deposit methods, including instant ACH transfers, traditional bank transfers, and deposits from linked bank accounts. Funds are typically available for trading within one to five business days.

How To Withdraw From Robinhood?

Initiating a withdrawal from Robinhood is equally simple.

- Select Account (person icon)→ Menu (3 bars) or Settings (gear)

- Select Transfers → Transfer money

- Choose the Robinhood account you want to withdraw money from

- Select a linked account to withdraw to, and if your account qualifies, you’ll see Instant transfers eligible next to the external account (in-app only)

- Enter the amount you’d like to transfer

- Review the withdrawal and confirm any associated fees

- Select Transfer

Robinhood Trading Platforms

Robinhood’s trading platforms, both the web platform and mobile app, are renowned for their user-friendly design and intuitive navigation. The platforms provide real-time market data, charting capabilities, and a range of order types to suit various trading strategies.

Asset Coverage

Robinhood offers a diverse array of financial instruments for trading, including stocks, ETFs, options, and cryptocurrencies. The broker provides access to major US exchanges and a selection of international markets.

Regulatory Compliance and Security

Robinhood, like all securities brokerage firms, is subject to regulation by the Securities and Exchange Commission (SEC). The SEC’s primary means of enforcing compliance is through civil prosecutions against individuals and companies that engage in fraudulent activities, spread false information, or indulge in insider trading. The SEC does not provide individual investors with any direct protection, nor does it insure against losses or safeguard investments from actions taken by brokerage firms.

Robinhood is also a member of the Financial Industry Regulatory Authority (FINRA), a self-regulatory organization (SRO) that most brokerage firms voluntarily join. SROs are supervised by the SEC but are not government entities. FINRA member brokerages adhere to the organization’s rules and regulations, which encompass agent and broker testing and licensing, as well as a transparent disclosure framework that safeguards investors’ interests.

Fees and Commissions

Robinhood’s no-commission trading model is its defining feature, making it an attractive choice for cost-conscious investors. The platform charges zero commission fees for stock, exchange-traded fund (ETF), cryptocurrency, and option trades executed through its app or website. This eliminates a significant barrier to entry for those seeking to participate in the financial markets without incurring substantial fees.

Customer Support

Robinhood’s customer support has been criticized for its limited availability and responsiveness. The broker primarily offers email and phone support, with limited chat support during business hours.

Educational Resources

Robinhood provides a range of educational resources to help investors learn and grow. The broker’s learning center offers articles, videos, and webinars on various investing topics.

Pros and Cons

Pros:

- User-friendly interface

- Commission-free trading

- Fractional shares

- Diversified asset coverage

Cons:

- Limited research tools

- Lack of customer support

- Potential hidden fees

Client Feedback and Reviews

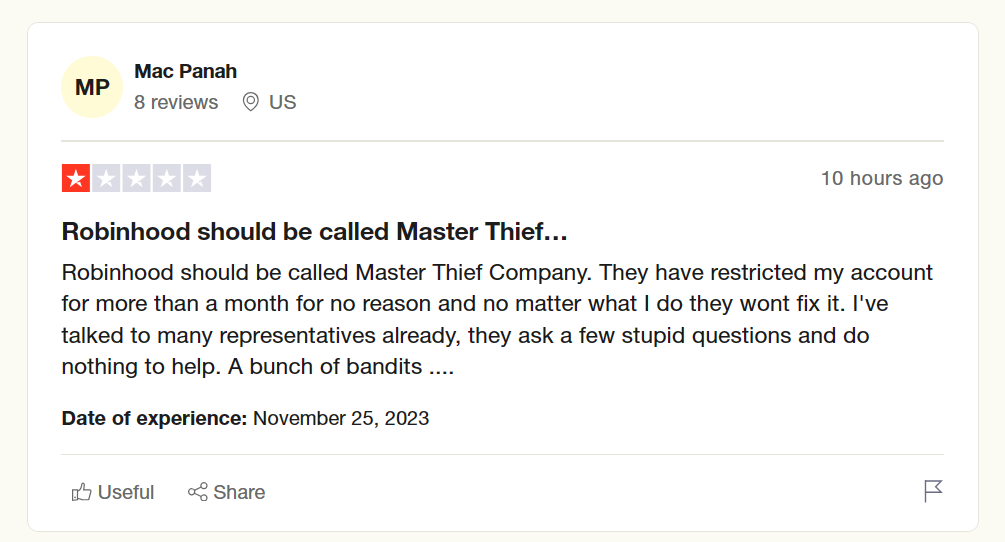

Client feedback on Robinhood is mixed. While many appreciate the broker’s user-friendly platform and commission-free trading, others have expressed dissatisfaction with the limited research tools and lack of customer support.

Robinhood Trustpilot reviews are the best way to have a good overview of their client satisfaction.

Also, there are some bad reviews too.

Comparison Between Robinhood and Other Brokers

Let’s have a look at the comparison between Robinhood, eToro, and Pepperstone. You can read the individual reviews on eToro and Pepperstone also.

| Feature | Robinhood | eToro | Pepperstone |

| Account Types | Margin, cash | Individual, Professional | Standard, Razor, Edge |

| Minimum Deposit | None | $50 – $1000 (depends on country) | $0 (Standard account only) |

| Leverage Options | Margin accounts offer up to 2x leverage | Up to 30x leverage for CFDs | Up to 50x leverage for Forex pairs |

| Asset Coverage | Stocks, ETFs, options, cryptocurrencies | Stocks, ETFs, CFDs, commodities, currencies, indices, cryptocurrencies | Forex pairs, commodities, indices, cryptocurrencies |

| Trading Platforms | Web platform, mobile app | Web platform, mobile app | Web platform, mobile app |

| Trading Fees | Commission-free for stocks, ETFs, options, cryptocurrencies | No commission fees for stocks, ETFs | Variable spreads for all asset classes |

| Regulatory Compliance | FINRA-regulated, SEC-registered | FCA (UK), CySEC (Cyprus), ASIC (Australia) | FCA (UK), BaFin (Germany), ASIC (Australia) |

| Customer Support | Email, phone, chat | Email, live chat, phone | Email, live chat, phone |

| Educational Resources | Learning center, webinars, tutorials | Webinars, tutorials, market analysis | Webinars, tutorials, trading guides |

If Anything Unwanted Happens, Contact Us

Robinhood has a good reputation for maintaining good client satisfaction. But, an accident can happen. If anything happens to you and you have no solution, you can contact us.

Report Scammed Bitcoin is a scam reporting platform, where scam victims can submit their incidents and also can have a free consultation from our experts. They will provide you with guidance and recovery service recommendations to recover your lost funds.

If you have lost money to companies like KuCoin, Webull, or RoboForex, please report it today by the below form.

Conclusion

Overall, Robinhood is a good option for beginner investors who are looking for a commission-free trading platform with a user-friendly interface. However, more experienced investors may want to consider a broker with more advanced features and better customer support.