What Is Ethereum

Ethereum the second most popular cryptocurrency after Bitcoin. The question arises in the mind “What is Ethereum?” Eithereum as a medium of commerce or a store of value, Ethereum differs from most other virtual currencies in that it aims to be far more than that.

Ethereum is considered to itself a blockchain-based decentralized computing network. Examine the implications.

An open-source platform

It’s possible to build and run decentralized digital applications, or “apps,” on Ethereum’s open-source blockchain platform, eliminating the need for a middleman to sell or exchange products and services.

If you don’t want to go through a crowdfunding website, you can set up your crowdfunding site to raise money for your project rather than going through an established crowdfunding website.

History of Ethereum

Vitalik Buterin, a 19-year-old Russian-Canadian, was the driving force behind the creation of Ethereum, which he envisioned as a way to democratize everything from organizations, businesses, Ethereum currencies, and even “your own country with an unchangeable constitution.”

Buterin’s goal was to take the technology that powered Bitcoin’s digital currency and use it to dButerin’s goal was to adopt Bitcoin’s digital currency-driven technology and use it to democratize everything from your own country, including organization, business, currency, and even the “immutable constitution.”Some of the most vocal critics of Buterin’s plan have come from the same organizations that stand to lose the most if he succeeds.

Thiel Fellowship and $100,000 prize for his work on the Ethereum white paper published in 2013. In July 2014, he launched a crowdfunding effort with the help of co-founders Dr. Gavin Wood and Joseph Lubin. Ethereum’s $18 million crowd sale was the most successful of its time, raising the most money from the general public. Frontier, the company’s initial platform, went live in July of that year.

How does Ethereum work?

1. A Part of currency:

Ethereum is based on a blockchain network, just like all other cryptocurrencies. All transactions are validated and recorded in a decentralized and dispersed public distributed ledger in a blockchain.

2. Who enters in Ethereum:

Everyone on the Ethereum network has an identical copy of this ledger, allowing them to observe all transactions in the past. Since no single entity controls or operates the web, it can be said to be decentralized. Instead, all of the distributed ledger holders are in charge of it.

3. Transaction protection:

Transactions on the blockchain are protected by encryption, which is used to ensure the integrity of the network. Instead of manually verifying each transaction on the web, machines are used to “mine” or solve complicated mathematical equations, adding new blocks to the system’s blockchain.

Participants receive bitcoin tokens as a reward for participating. Ethereum currency is the name given to these tokens in the Ethereum system (ETH).

4. Different from other cryptocurrencies:

Ether can be used to buy and sell goods and services, just like Bitcoin. Recent price increases have made it de facto a speculative investment. Ethereum, on the other hand, is unique in that it allows users to create apps that operate on the blockchain in the same way that computer software does.

Personal data of the cryptocurrency is stored and transferred, and these programs can handle financial transactions.

When it comes to the mining process, Ethereum differs from Bitcoin in that it allows the network to conduct computations as part of the effort. Bitcoin’s “fundamental computational capabilities” transform it into a “decentralized global computing engine and freely verifiable data storage,” according to the author.

How to buy Ethereum

A proper bank or an online brokerage like Vanguard or Fidelity will not allow you to buy cryptocurrency. As an alternative, you’ll have to use a best crypto exchange.

For more experienced investors, there are a wide variety of cryptocurrency exchanges with a wide range of features. Before joining a platform, it’s good to research what is Ethereum, its cost, security measures, and other features.

1. Make an account

An account with a crypto exchange will very definitely require you to provide some personal information and have your identity validated. Your bank account or debit card will need to be linked before depositing into your new account. Depending on which option you select, fees may differ.

A funded account does not imply ownership of Ethereum, and like with any investment account, you don’t want your unspent funds to sit there unused. To invest, you’ll need to get your hands on some Ethereum.

2. Concerns About Ethereum Regulatory Status

Security concerns:

The Securities and Exchange Commission (SEC) has questioned whether Ethereum should be treated as a security and hence be subject to regulation. The continuing SEC and DOJ investigations into bitcoin and other cryptocurrencies have been another dark cloud hanging.

An ex-CFTC chairman, Gary Gensler, stated that “there is a strong case that one or both [Ethereum and Ripple] are non-compliant securities,” which sank the altcoin. Worries that only registered stockbrokers would be able to trade in Ether were raised when the word “non-compliant” was used. The report at the moment sent Ether tumbling.

Rules for transactions from the bank:

Cryptocurrency restrictions have yet to be implemented despite the SEC’s director of corporate finance, William Hinman, stating that Ether and the Ethereum network are not securities transactions in June.

Crypto’s future is still uncertain, even if the CFTC has indicated that it considers bitcoin a commodity. In addition to regulatory pressure, banks, brokerages, and economists have been a constant source of criticism for crypto this year.

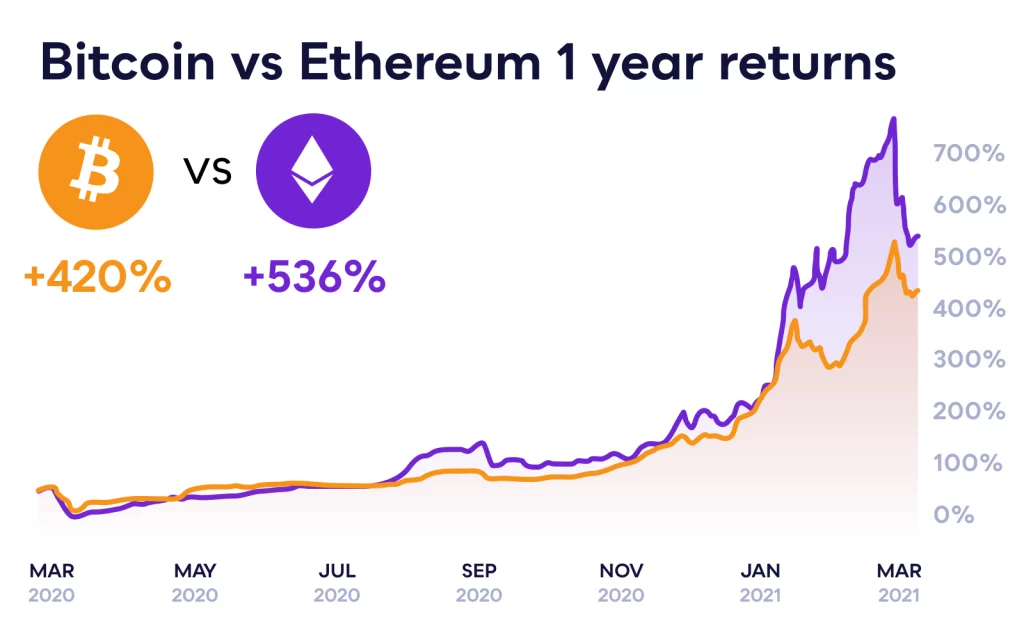

Ethereum vs. Bitcoin

About Ethereum:

In addition to allowing digital currency, blockchain technology is being leveraged to develop new applications. So we can say that Ethereum is the largest and most established open-ended decentralized software platform today.

About Bitcoin:

Several attempts have been made to create a cryptocurrency. Still, bitcoin has been the most successful and widely regarded as a forerunner. Many of the others have been produced in the last decade.

Major Difference:

- In the wake of Bitcoin’s launch, a new digital currency emerged. Any government or organization did not control that.

- Many individuals began to recognize that the blockchain, a key bitcoin innovation, might be used for other purposes as time went on.

- To enable tamper-proof decentralized financial contracts and apps, Ethereum proposes leveraging blockchain technology and maintaining a decentralized payment network.

- The Ethereum network’s currency, Ether, power Ethereum apps and contracts. Ether has emerged as a rival to bitcoin on cryptocurrency exchanges, even though it was designed to complement rather than compete.

Advantages And Disadvantage Of Ethereum

Advantage:

Ethereum has a few advantages over other innovative contract platforms.

1. Decentralization.

After Bitcoin, Ethereum is the second most decentralized cryptocurrency. Vitalik Buterin and ConsenSys have a lot of influence, yet the project is decentralized, and no one person or organization has complete control over it.

Other innovative contract platforms, including NEO and Tron, are not like this. Centralized control of the network is an issue with these platforms. There is a possibility that a transaction could be reversed or that an account could be frozen if necessary.

Is that a realistic possibility? No. It’s pretty unlikely, but it’s not a certainty. Centralization is a concern, and having a decentralized network like Ethereum is best to protect yourself from it.

2. A Stable Group of Developers

More people work on Ethereum than on Bitcoin, thanks to its enormous developer community. Compared to other protocols, Ethereum has a significant advantage.

There is a need to do a lot of work to make blockchain-based cryptocurrencies relevant to the typical individual. With so many developers, Ethereum has a better chance of finding product-market fit, which will lead to broad adoption.

3. The ability to communicate with other systems:

Hundreds of existing protocols can be easily integrated into your app when built on the Ethereum platform. It is known as “money legos” in the Ethereum community. Even though the video below is a few years old, it does an excellent job of illustrating how protocols can interact.

Recent fashionable financial products have been designed and released on Ethereum in just a few short weeks. Rather than starting from scratch, these protocols can connect to existing infrastructure.

Disadvantage:

According to a report released in June, the Bank of International Settlements, which is made up of 60 central banks that stand to lose a great deal if crypto were to take over the role of fiat currency, crypto has a few major weak points, including:

- Its inability to be scaled,

- Its lack of value stability,

- Lack of trust in the finality of its payments.

Even though Ethereum is a fantastic platform, it is far from flawless. Ethereum is currently dealing with several significant issues.

1. Slow-Speed:

Decentralized protocols like Bitcoin and Ethereum are notoriously sluggish. There are 7 TPS (Transactions Per Second) for Bitcoin and 15 TPS (Transactions Per Second) for Ethereum. That’s twice as fast as Bitcoin, but it’s still far from sufficient.

Which has grown highly congested due to the growing popularity of Defi and yield farming in particular? Transaction fees surged up to 100 times their average amount or more for a brief period, resulting in astronomical expenses.

A $5 transaction, for example, could cost $50 or $100 to execute, but a $50 or $100 transaction employing a smart contract would be considered straightforward.

It’s not a big deal if the network gets crowded for a few days. However, Ethereum has been facing high traffic and costs for more than a month since October 2020. As a result, the platform may no longer be financially viable for users to continue utilizing.

2. Ethereum’s code is unchangeable:

After a hacker discovered a vulnerability in the MakerDAO smart contract in 2016, they were able to steal around $50 million worth of ETH.

Cryptocurrency enthusiasts chose to “reverse” this exploit by forking the Ethereum network rather than allowing it to continue as-is. That happened nearly six years ago, but the question is whether or not it can be done again.

And the answer is most likely not. Since then, Ethereum has expanded significantly, making it more difficult to persuade all major parties to agree to a rollback.

But to a different or lesser extent, the memory of this reversal persists. Ethereum’s immutability is still an open subject, particularly compared to a cryptocurrency like Bitcoin.

3. Language as a Component of Programming:

Solidity is a programming language required for Ethereum network app and token development. A new programming language with well-known issues.

It means that programmers will have to learn a new programming language to implement smart contracts. As a result, it’s becoming increasingly typical for intelligent contracts to contain flaws.

A hacker can still uncover an exploit even when a smart contract has been audited (by a third party to confirm that the code is secure). You Can also Hire a hacker for recovering your stolen cryptocurrency.

Other intelligent contract systems employ programming languages that are easier for developers to understand and implement. For example, using the Marlowe programming language, Cardano seeks to make it easier to design smart contracts that aren’t vulnerable to exploitation.

What Is Ethereum Future

Every week, new initiatives are launched, and existing ones gain traction due to the volume of work being done. It was a big thing in the summer of 2020 when the worth of Defi was $3 billion. After only a few months, the locked value has risen to about $11 billion.

- In just a few months, the value of Defi rise from $3 billion to $11 billion.

- One more thing to keep an eye out for in the following years, in addition to Defi:

- Off-chain methods, such as ZK-Rollups, can help with scaling. It’s taken a long time to build technology that periodically verifies off-chain transactions on the blockchain. There will be less network congestion when several scaling solutions go live in late 2020 and early 2021.

- EY has invested millions of dollars in research into making Ethereum more private in the past several years. EY, a consultancy firm, believes that Ethereum’s privacy protections will make it easier for institutions to adopt the cryptocurrency. While privacy benefits everyone, new privacy solutions should be sought out in 2021.

- A stakeout is imminent! Ethereum investors will be able to generate a passive income just by keeping and staking Ethereum, thanks to this new feature. The coin price has risen significantly after other blockchains like Cardano and Tezos added staking.

- There are various ways to stay updated on the ever-changing Ethereum Environment for anyone interested. The Defiant and the Bankless newsletter are two excellent resources for up-to-date information.