Cryptocurrency 101

To assist you in comprehending the revolutionary financial innovation, this article will explore numerous ideas related to cryptocurrency.

Cryptocurrency is a digital currency meant to be used for trading. To manage the generation of new digital currency units, it employs cryptography to safeguard and verify transactions.

Many cryptocurrencies rely on blockchain technology, a distributed ledger maintained by a network of computers, to operate. Unlike fiat currencies like the U.S. dollar or the British pound, cryptocurrencies are not issued by any central body, making them theoretically immune to government interference or manipulation.

How Does Cryptocurrency Work?

The vast majority of cryptocurrencies are decentralized and do not need the support of a central bank or government. Blockchain technology, which is decentralized and decentralized in nature, underlies the functioning of cryptocurrencies rather than depending on government assurances.

Cryptocurrencies do not exist in the form of a stack of notes or coins like traditional currencies. Instead, they rely only on the internet to survive. Assume that they are virtual tokens, the value of which is determined solely by market forces generated by persons trying to acquire or sell them.

Who Was Involved In The Rise Of Bitcoin?

Several individuals have had a major effect on the cryptocurrency sector throughout its history. Bitcoin, created by Satoshi Nakamoto, was the spark that ignited the cryptocurrency industry (BTC). Vitalik Buterin, best known for creating the cryptocurrency Ethereum (ETH), has also significantly affected the cryptocurrency movement. With Ethereum came a slew of new tokens based on its network, known as ERC-20 tokens, created by third parties.

Mt. Gox, founded by Jed McCaleb, became a popular Bitcoin trading platform in the early days of the industry, despite its original purpose as a gathering place for fans of a card game called Magic: The Gathering. As a result of his efforts, Bitcoin rose to prominence in the industry’s early days. However, when the platform collapsed in 2014, it became known worldwide.

Are Cryptocurrencies Too Volatile?

Because of the newness of the cryptocurrency business, there is a great deal of volatility in the market. Investors are attempting to experiment with their money to acquire wealth as rapidly as possible and determine how cryptocurrency values fluctuate and if they can influence them.

The number of individuals who use cryptocurrencies (i.e., their usefulness) and why they have used them influence their price. It is more likely that the price will grow if more individuals utilize their coins to purchase products and services rather than just keeping them.

Types of Cryptocurrency

Different kinds of cryptocurrencies may be divided into two categories based on their characteristics:

Coins are meant to be used as a kind of money, and they are generated on their own Blockchain, similar to that of a cryptocurrency. The cryptocurrency Ether, for example, is based on the Ethereum blockchain and is a kind of digital asset.

An “Altcoin” is a cryptocurrency built on the Blockchain but is not the same as Bitcoin. Alternative to Bitcoin (also known as “altcoin”) was invented as a slang phrase for “alternative to Bitcoin,” and the great majority of altcoins were developed to make Bitcoin better in some way. Altcoins include Namecoin, Peercoin, Litecoin (LTC), Ethereum, and USD Coin (USDC), among others.

Some cryptocurrencies, such as Bitcoin, have a limited amount of coins available, which helps stimulate demand and increase the perceived value of the cryptocurrency. For example, the maximum supply of Bitcoin is set at 21 million units, as established by the cryptocurrency’s founder, Charlie Shrem (s).

Tokens are created on top of an existing blockchain. Still, they are regarded as programmable assets since they allow for the creation and execution of one-of-a-kind smart contracts. These contracts may be used to establish ownership of assets even if the blockchain network is not utilized. Tokens may be used to represent units of value such as money, coins, digital assets, and energy, and they can be given and received in the same way as other forms of value.

Stablecoins are digital coins whose values are tied to the value of different fiat currencies or assets, such as gold. Users may sell into Stablecoins, which are most typically linked one-to-one to the value of the United States dollar, and receive an asset having the same value as a national currency but which can still be transacted and held in a crypto-like form inside the ecosystem.

Is Cryptocurrency Legal And Safe?

With the advent of the cryptocurrency business, governments throughout the globe have begun to regulate it. Over the years, the United States has steadily increased the number of people watching the skies. Following the cryptocurrency craze of 2017 and 2018, the Securities and Exchange Commission (SEC) took action against initial coin offerings or ICOs. The Commodity Futures Trading Commission (CFTC) and other U.S. government organizations have also been involved differently.

Advantages And Disadvantages Of Cryptocurrency

The procedure is typically quick and clear when it comes to Bitcoin transactions. Cryptocurrencies such as Bitcoin, for example, may be swapped between digital wallets with nothing more than a smartphone or computer. Security measures like public and private keys and different incentive systems such as proof-of-work and proof of stake are used to ensure the integrity of these transactions. It is becoming more common to make payments in cryptocurrencies, particularly among major firms and in areas such as fashion and pharmaceuticals.

Every cryptocurrency transaction is recorded on a public ledger known as the Blockchain, which is the technology that makes it possible for it to exist. The Blockchain is a distributed ledger that is accessible to everyone. This enables consumers to track the history of cryptocurrencies such as Bitcoin, which prevents them from spending coins they don’t own, cloning transactions, or redoing previously completed transactions. To remove middlemen such as banks and online marketplaces, Blockchain is designed to have no transaction fees.

However, it is probable that you may misplace your virtual wallet or that you will lose your money. There have also been thefts from Bitcoin storage platforms on the internet reported in the past. The volatility of cryptocurrency values, particularly Bitcoin, has caused some consumers to be wary about converting “actual” money into cryptocurrencies such as Bitcoin.

Furthermore, since regulators like the Financial Conduct Authority (FCA) do not control the cryptocurrency market, there are no guidelines to safeguard your company. Its value might plummet, and it could become worthless if businesses or consumers migrate to a new cryptocurrency or cease using digital currencies entirely.

What Does Blockchain Mean in Cryptocurrency?

Distributed ledger technology (DLT) is a decentralized database that is administered by several different network members. Blockchain is a sort of distributed ledger technology in which transactions are recorded using a hash, which is an immutable cryptographic signature to ensure that they are not altered. In other words, if even a single block in a chain is changed, it will be readily apparent that the chain has been tampered with. However, it is possible to create private and centralized blockchains where all the machines that comprise the network are controlled and administered by a single organization.

Are Blockchain and Cryptocurrency The Same?

Blockchains may be used to provide decentralized systems that need the use of a currency. The Blockchain is a distributed ledger system that enables a network to maintain consensus by recording transactions. Because of distributed consensus, the network can track transactions and transfer value and information.

From a business aspect, blockchain technology may be seen as a next-generation business process optimization software, similar to enterprise resource planning software. Collaborative technology, such as Blockchain, has the potential to enhance business operations between companies while simultaneously lowering the “cost of trust” significantly. Therefore, it may provide higher returns per dollar invested than most typical internal investments.

How Do You Buy Cryptocurrency?

Because of the rapid growth of Bitcoin use, there are many options for purchasing cryptocurrency. Crypto-native exchanges provide various digital assets for purchase and sale on a decentralized platform. PayPal, widely used in the mainstream world, PayPal is an example of a platform where members may purchase and sell specific digital assets. ATMs that accept cryptocurrency, such as Bitcoin ATMs, are also available in numerous locations throughout the globe.

When it comes to paying for assets, platforms accept payments in bank transfers, cryptocurrency transfers, or credit cards, depending on the platform. It is also feasible to purchase cryptocurrency with cash in a person-to-person transaction. The availability of cryptocurrency for purchase and sale on any specific platform, on the other hand, might differ from country to region.

Is cryptocurrency taxable?

While technically referred to as “virtual currencies,” Bitcoin and other cryptocurrencies are treated as assets for the purposes of capital gains taxation. As a result, “ordinary” investors who purchase Bitcoin as an investment will realize a capital gain or loss when they exchange it for traditional currency, goods, or services.

Cryptocurrency taxes include:

- Corporation tax: Currency exchange gains and losses, including virtual currencies, are taxed. A company’s gains and losses from Bitcoin transactions would be taxed under conventional corporate tax standards.

- Chargeable gains: Whether gains or losses on Bitcoin or other cryptocurrencies (which are not trading earnings) are chargeable or allowable for capital gains tax or chargeable gains for corporation tax.

- Income tax: Profits and losses from cryptocurrency transactions are taxable/allowable under traditional income tax standards.

Are Cryptocurrencies A Good Investment?

Purchase cryptocurrency to acquire direct exposure to the demand for digital money or buy stocks of firms that deal in cryptocurrencies to gain indirect exposure.

While no cryptocurrency venture is certain to succeed, early investors may be richly rewarded if its goals are met. Long-term success requires the broad acceptance of cryptocurrencies.

What Is Cryptocurrency Mining And How Does It Work?

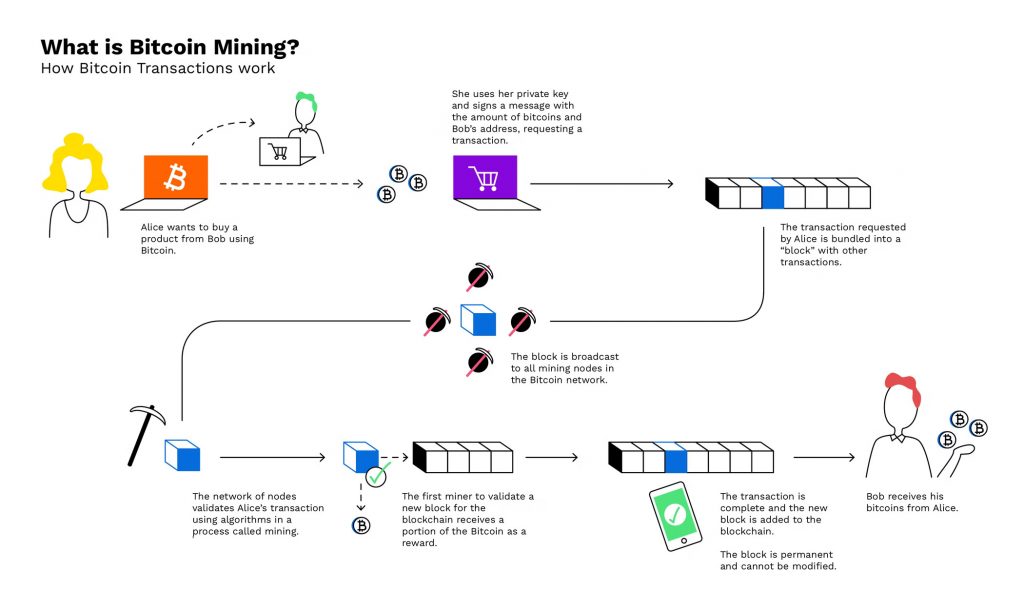

Bitcoin mining is the process of earning cryptocurrency by solving challenging mathematical problems and recording data to a blockchain.

But why do people mine crypto? The apparent explanation is that some individuals desire a second job, while others want greater financial independence from governments and banks. For example, crypto miners validate transactions in return for Bitcoin.

A cryptocurrency blockchain is built on transactions. Cryptographic hashes and other critical information are stored in a chain of connected data blocks. A blockchain comprises blocks of data transactions uploaded to the ledger. This increases transparency by enabling network users to see their transactions uploaded to the Blockchain. Review and compare the best Cryptocurrencies to help you understand how to mine cryptocurrency, and select the best cryptocurrency to mine.

How Can Cryptocurrency Be Used To Make Purchases?

Depending on the cryptocurrency you hold, you can perform various things. A cryptocurrency asset may be used to move value between people or pay for products and services.

Because each item has a monetary worth, another use case arises from trading and investment. Most cryptocurrencies, except Stablecoins, vary in price, with some pegged to other assets like the U.S. dollar. You may trade between cryptocurrencies and fiat currencies on exchanges, depending on the trading pairings offered.

You may accept digital assets directly or via a payment processor or service if you are a merchant. Some businesses instantly turn cryptocurrency into cash, while others provide crypto-top-up debit cards that look and feel like any other plastic card used to pay for products and services.

The popularity of cryptocurrency is rapidly growing and so is the crime associated with it. Scammers, fraudsters, and hackers have found the crypto market. Thats why you should know about – How To Analyze And Recover Stolen Crypto.

What Is The Future Of Cryptocurrency?

Cryptocurrency has advanced rapidly during the previous decade. The value may be held, transferred, and spent in many ways, and DeFi has paved the door for new borrowing and lending methods.

Some mainstream firms are also interested in blockchain technology, investigating possibilities such as supply chain. The rise and popularity of cryptocurrencies and related technologies since 2008, when Nakamoto revealed the structure for a small asset called Bitcoin, indicate a promising future.